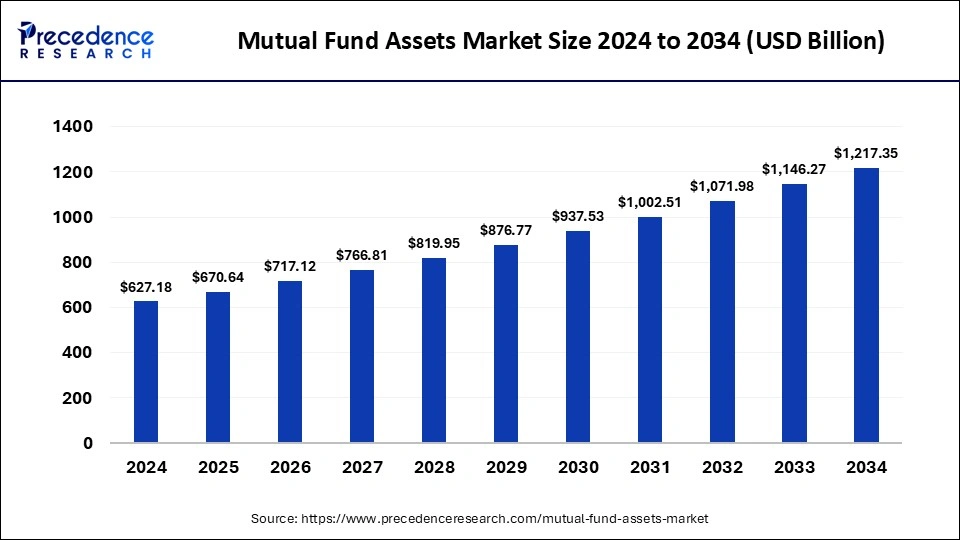

The global mutual fund assets market size is expected to increase USD 1146.27 billion by 2033 from USD 586.53 billion in 2023 with a CAGR of 6.93% between 2024 and 2033.

Mutual Fund Assets Market Key Takeaway

- The North America mutual fund assets market size accounted for USD 199.42 billion in 2023 and is expected to attain around USD 395.46 billion by 2033, poised to grow at a CAGR of 7.08% between 2024 and 2033.

- North America has held a major revenue share of 34% in 2023.

- Asia Pacific is expected to host the fastest-growing market during the forecast period.

- By investment strategy, the equity strategy segment held the largest share of the market in 2023.

- By investment strategy, the sustainable strategy segment is expected to grow rapidly in the market during the forecast period.

- By type, the open-ended segment has contributed more than 84% of revenue share in 2023.

- By type, the close-ended segment is expected to rapidly expand in the global market during the forecast period.

- By distribution channel, the direct sales segment has generated more than 37% of revenue share in 2023.

- By distribution channel, the financial advisors segment is expected to grow rapidly in the market during the forecast period.

- By investment style, the active segment has recorded the largest revenue share of 73% in 2023.

- By investment style, the passive segment is expected to gain a significant share of the market during the forecast period.

- By investor type, the retail segment has held a major revenue share of 60% in 2023.

- By investor type, the institutional segment is expected to grow rapidly in the market during the forecast period.

The mutual fund assets market encompasses a wide range of investment vehicles pooled from various investors to invest in diverse asset classes such as stocks, bonds, and money market instruments. These funds are managed by professional portfolio managers who aim to generate returns for investors while managing risks. The market size and structure of mutual fund assets have evolved significantly over the years, influenced by economic conditions, regulatory changes, and investor preferences.

Get a Sample: https://www.precedenceresearch.com/sample/4409

Growth Factors:

Several factors contribute to the growth of the mutual fund assets market. Firstly, increasing financial literacy and awareness among investors drive demand for investment products like mutual funds. Additionally, the convenience and accessibility of mutual funds through online platforms have expanded their reach to a broader investor base. Moreover, favorable regulatory environments and tax incentives provided by governments encourage investments in mutual funds, fostering market growth.

Region Insights:

The mutual fund assets market exhibits variations across regions due to differences in regulatory frameworks, investor preferences, and economic conditions. In developed markets like the United States and Europe, mutual fund assets constitute a significant portion of total investable assets, driven by robust financial infrastructure and a culture of investment. In emerging markets such as India and China, the mutual fund industry is experiencing rapid growth fueled by rising incomes, urbanization, and increasing investor participation.

Mutual Fund Assets Market Scope

| Report Coverage | Details |

| Mutual Fund Assets Market Size in 2023 | USD 586.53 Billion |

| Mutual Fund Assets Market Size in 2024 | USD 627.18 Billion |

| Mutual Fund Assets Market Size by 2033 | USD 1,146.27 Billion |

| Mutual Fund Assets Market Growth Rate | CAGR of 6.93% from 2024 to 2033 |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Investment Strategy, Type, Distribution Channel, Investment Style, Investor Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Mutual Fund Assets Market Dynamics

Drivers:

Several drivers influence the performance and dynamics of the mutual fund assets market. Market performance, economic indicators, and interest rate movements affect the returns generated by mutual funds, influencing investor sentiment and fund flows. Additionally, technological advancements and innovations in financial services enable fund managers to offer innovative products and strategies, attracting investors seeking higher returns or specific investment objectives.

Opportunities: T

he mutual fund assets market presents numerous opportunities for investors, fund managers, and other stakeholders. For investors, mutual funds offer diversification, professional management, and access to a wide range of asset classes, catering to different risk appetites and investment goals. Fund managers can capitalize on emerging market trends, niche investment strategies, and technological advancements to attract investors and enhance fund performance.

Challenges:

Despite its growth potential, the mutual fund assets market faces several challenges. Market volatility, regulatory changes, and geopolitical uncertainties can impact fund performance and investor confidence. Moreover, increasing competition among fund managers puts pressure on fees and profitability, necessitating continuous innovation and differentiation. Additionally, educating investors about the risks and benefits of mutual fund investments remains a challenge in many regions, requiring concerted efforts from industry participants and regulators.

Read Also: Electrosurgical Generators Market Size to Worth USD 3.53 Bn by 2033

Mutual Fund Assets Market Recent Developments

- In January 2024, A hybrid fund called the Multi-Asset Allocation Fund was introduced by Bandhan Mutual Fund. It would invest in a variety of asset classes, with 50% of the allocation going into Indian stocks. 10% will go toward actively managed high-quality Fixed Income, 15% will go toward fully hedged arbitrage strategies, 15% will go toward international equities across the US and other developed markets as well as emerging markets, and 10% will go toward domestic gold and silver, according to the fund house.

- In February 2024, HSBC Mutual Fund introduced the HSBC Multi Asset Allocation Fund, an open-ended scheme that invests in debt and money market securities, gold/silver ETFs, and equities and equity-related instruments. The scheme’s new fund offer, or NFO, will be available for subscription starting on February 8 and ending on February 22.

Mutual Fund Assets Market Companies

- Black Rock

- UTI Mutual Fund

- Morgan Stanley

- PIMCO

- DSP Mutual Fund

- Trustee

- JPMorgan Chase & Co

- Capital Group

- Vanguard

Segment Covered in the Report

By Investment Strategy

- Equity Strategy

- Fixed Income Strategy

- Multi-Asset/Balanced Strategy

- Sustainable Strategy

- Money Market Strategy

- Others

By Type

- Open-ended

- Close-ended

By Distribution Channel

- Direct Sales

- Financial Advisor

- Broker-Dealer

- Banks

- Others

By Investment Style

- Active

- Passive

By Investor Type

- Retail

- Institutional

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/