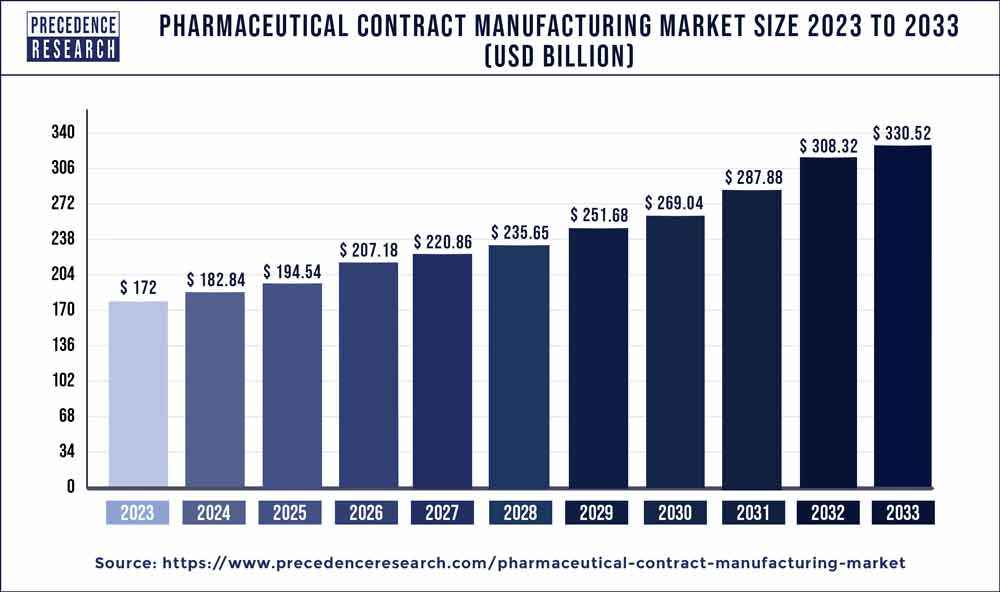

The global pharmaceutical contract manufacturing market size accounted for USD 172 billion in 2023 and is expected to hit around USD 330.52 billion by 2033, notable at a CAGR of 6.80% from 2024 to 2033.

Key Takeaways

- North America contributed 36% of market share in 2023.

- Asia-Pacific is estimated to expand the fastest CAGR between 2024 and 2033.

- By service, the pharmaceutical manufacturing services segment has held the largest market share of 33% in 2023.

- By service, the drug development services segment is anticipated to grow at a remarkable CAGR of 8.9% between 2024 and 2033.

- By end-user, the big pharmaceutical companies segment generated over 42% of revenue share in 2023.

- By end-user, the small & mid-sized pharmaceutical companies segment is expected to expand at the fastest CAGR over the projected period.

The pharmaceutical contract manufacturing market has witnessed significant growth in recent years, driven by the increasing demand for pharmaceutical products, outsourcing strategies adopted by pharmaceutical companies, and advancements in technology. Pharmaceutical contract manufacturing involves outsourcing the production of pharmaceutical products to third-party manufacturers, allowing pharmaceutical companies to focus on their core competencies such as research and development, marketing, and distribution. This market encompasses a wide range of services including active pharmaceutical ingredient (API) manufacturing, finished dose formulation, packaging, and labeling.

The global pharmaceutical contract manufacturing market has experienced steady growth, with key players expanding their manufacturing capacities and capabilities to meet the growing demand for pharmaceutical products. This trend is expected to continue as pharmaceutical companies seek to reduce costs, improve efficiency, and accelerate time-to-market for their products. Additionally, the increasing complexity of drug development and manufacturing processes, as well as stringent regulatory requirements, have further fueled the demand for contract manufacturing services.

Get a Sample: https://www.precedenceresearch.com/sample/3750

Growth Factors:

Several factors contribute to the growth of the pharmaceutical contract manufacturing market. One of the primary drivers is the cost-effectiveness and flexibility offered by contract manufacturing, allowing pharmaceutical companies to access specialized manufacturing facilities and expertise without the need for significant capital investment. Additionally, outsourcing manufacturing activities enables pharmaceutical companies to mitigate risks associated with fluctuations in demand, regulatory changes, and technological advancements.

Moreover, the globalization of the pharmaceutical industry has led to increased outsourcing of manufacturing activities to regions with lower production costs, such as Asia-Pacific and Latin America. This shift towards outsourcing has been further accelerated by the rising demand for generic drugs, biosimilars, and specialty pharmaceuticals, which require specialized manufacturing capabilities and expertise.

Furthermore, the increasing prevalence of chronic diseases, aging population, and growing healthcare expenditure in emerging markets have contributed to the expansion of the pharmaceutical contract manufacturing market. As pharmaceutical companies strive to expand their market presence and improve access to healthcare globally, outsourcing manufacturing activities has become essential to meet the diverse needs of patients and healthcare providers.

Pharmaceutical Contract Manufacturing Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 6.80% |

| Global Market Size in 2023 | USD 172 Billion |

| Global Market Size by 2033 | USD 330.52 Billion |

| U.S. Market Size in 2023 | USD 43.34 Billion |

| U.S. Market Size by 2033 | USD 84.07 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Service and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Pharmaceutical Contract Manufacturing Market Dynamics

Drivers:

Several drivers are propelling the growth of the pharmaceutical contract manufacturing market. One significant driver is the increasing complexity of drug development and manufacturing processes, driven by advancements in biotechnology, personalized medicine, and specialty pharmaceuticals. These innovations require specialized manufacturing capabilities and expertise, which pharmaceutical companies may not possess in-house, thus driving the demand for contract manufacturing services.

Additionally, the growing emphasis on cost containment and operational efficiency within the pharmaceutical industry has led to increased outsourcing of manufacturing activities. Contract manufacturing allows pharmaceutical companies to optimize their resources, reduce manufacturing costs, and improve supply chain efficiency, thereby enhancing their competitive advantage in the market.

Furthermore, the expanding biopharmaceutical market, fueled by the development of biologics, gene therapies, and cell-based therapies, has created new opportunities for contract manufacturing organizations (CMOs). Biopharmaceuticals require advanced manufacturing technologies and specialized facilities, making outsourcing an attractive option for pharmaceutical companies seeking to expedite the development and commercialization of these innovative therapies.

Moreover, the increasing regulatory scrutiny and quality standards imposed by regulatory authorities have necessitated compliance with good manufacturing practices (GMP) and other regulatory requirements. Contract manufacturing organizations (CMOs) often have extensive experience and expertise in navigating regulatory complexities, thereby providing pharmaceutical companies with assurance of product quality, safety, and compliance.

Restraints:

Despite the favorable growth prospects, the pharmaceutical contract manufacturing market faces several restraints that may hinder its growth trajectory. One of the primary restraints is the risk of intellectual property (IP) infringement and loss of proprietary information associated with outsourcing manufacturing activities to third-party manufacturers. Pharmaceutical companies may be reluctant to disclose sensitive information or entrust critical manufacturing processes to external partners, fearing the risk of IP theft or unauthorized disclosure.

Additionally, the lack of transparency and control over the manufacturing process, supply chain, and quality management systems pose challenges for pharmaceutical companies outsourcing manufacturing activities. Ensuring product quality, consistency, and compliance with regulatory requirements may be more challenging when relying on external manufacturing partners, potentially impacting the reputation and credibility of pharmaceutical companies.

Furthermore, geopolitical tensions, trade disputes, and regulatory uncertainties in key manufacturing regions may disrupt the supply chain and increase operational risks for pharmaceutical companies outsourcing manufacturing activities. Supply chain disruptions, delays in regulatory approvals, and changes in trade policies can have significant implications for product availability, time-to-market, and overall business continuity.

Moreover, the fragmented nature of the pharmaceutical contract manufacturing market, characterized by a large number of small and medium-sized contract manufacturing organizations (CMOs), may pose challenges in terms of quality standards, capacity constraints, and service capabilities. Pharmaceutical companies may face difficulties in identifying suitable manufacturing partners that align with their specific requirements and quality standards, thereby limiting their outsourcing options.

Opportunity:

Despite the challenges, the pharmaceutical contract manufacturing market presents significant opportunities for growth and innovation. One key opportunity lies in strategic partnerships and collaborations between pharmaceutical companies and contract manufacturing organizations (CMOs) to leverage complementary strengths and capabilities. By fostering strategic alliances, pharmaceutical companies can gain access to specialized manufacturing expertise, innovative technologies, and global manufacturing networks, while CMOs can expand their customer base and enhance their service offerings.

Moreover, the increasing adoption of advanced manufacturing technologies such as continuous manufacturing, 3D printing, and artificial intelligence (AI) in pharmaceutical manufacturing presents new opportunities for efficiency improvements, cost savings, and product innovation. Contract manufacturing organizations (CMOs) that invest in advanced manufacturing capabilities and digital technologies are well-positioned to capitalize on these opportunities and differentiate themselves in the competitive market landscape.

Furthermore, the growing demand for personalized medicine, precision therapies, and orphan drugs presents niche opportunities for contract manufacturing organizations (CMOs) specializing in small-scale, high-value manufacturing. These specialized products often require customized manufacturing solutions, flexible production processes, and rapid scale-up capabilities, making outsourcing an attractive option for pharmaceutical companies seeking to bring innovative therapies to market.

Additionally, the increasing focus on sustainability, environmental responsibility, and green manufacturing practices presents opportunities for contract manufacturing organizations (CMOs) to differentiate themselves and gain a competitive edge. By adopting sustainable manufacturing practices, reducing waste, and optimizing energy consumption, CMOs can enhance their corporate social responsibility (CSR) initiatives and appeal to environmentally conscious pharmaceutical companies and consumers.

Read Also: U.S. Insulation Market Size to Worth USD 19.96 Bn by 2033

Recent Developments

- In September 2022, Lonza Group entered into a partnership with Touchlight, a biotechnology company, to enhance its comprehensive mRNA manufacturing capabilities by incorporating an additional source of DNA.

- In February 2022, Thermo Fisher Scientific collaborated with Moderna, Inc. to facilitate the large-scale production of Moderna’s COVID-19 vaccine, Spikevax, and other experimental mRNA therapies in its development pipeline.

- In January 2023, Catalent played a crucial role in supporting the manufacturing process for Sarepta’s advanced gene therapy candidate, delandistrogene moxeparvovec (SRP-9001), designed to address Duchenne muscular dystrophy.

Pharmaceutical Contract Manufacturing Market Companies

- Lonza Group

- Catalent, Inc.

- Patheon (Now part of Thermo Fisher Scientific)

- Recipharm AB

- Boehringer Ingelheim

- Dr. Reddy’s Laboratories

- Jubilant Life Sciences

- Fareva

- Vetter Pharma

- Evonik Industries

- WuXi AppTec

- Pfizer CentreOne

- Almac Group

- AbbVie Contract Manufacturing

- Samsung Biologics

Segments Covered in the Report

By Service

- Pharmaceutical Manufacturing Services

- Pharmaceutical API Manufacturing Services

- Pharmaceutical FDF Manufacturing Services

- Drug Development Services

- Biologic Manufacturing Services

- Biologic API Manufacturing Services

- Biologic FDF Manufacturing Services

By End User

- Big Pharmaceutical Companies

- Small & Mid-Sized Pharmaceutical Companies

- Generic Pharmaceutical Companies

- Other End Users (Academic Institutes, Small CDMOs, and CROs)

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/