Pharmacy Type Market (By Product: Prescription, and OTC; By Pharmacy: Retail, e-Pharmacy; By Application: Hospital-grade, Personal Use) – Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2022 – 2030

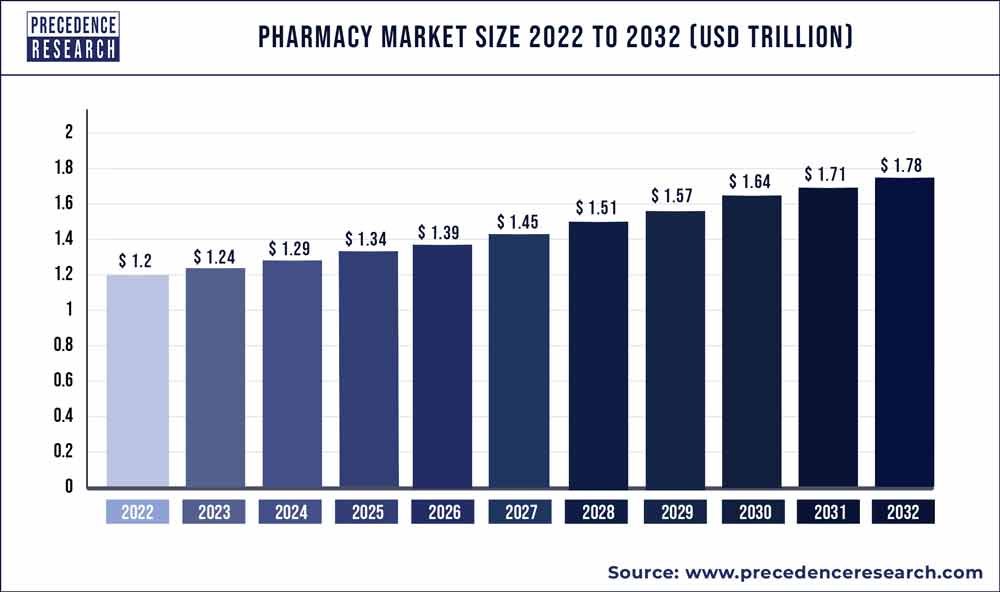

The pharmacy market size is expected to reach around US$ 6 billion by 2030, growing at a CAGR of 4% every year, according to a 2022 study by Precedence Research, the Canada-based market Insight Company.

The base year for the study has been considered 2021, the historic year 2017 and 2020, the forecast period considered is from 2022 to 2030. The pharmacy market is analyzed on the basis of value (US$ Million), volume (Unit), and price (US$/Unit).

The E-pharmacy market’s rapid growth is a crucial factor driving the market. The introduction of e-pharmacies is being aided by a dramatic increase in online purchasing of pharmaceuticals during the COVID-19 epidemic, as well as increased acceptance of digital technologies. Furthermore, big e-commerce companies are venturing into the e-pharmacy industry, bolstering market growth prospects.

Many pharmacies have begun to implement clinical programs aimed at promoting medication adherence and improving health outcomes. They’re also using subscription and loyalty programs to boost patient involvement. Prescription refills are now available online through pharmacies’ websites, smartphone apps, and automated telephonic systems. The market is growing due to leading players’ increasing embrace of automation technology and digitalization activities.

North America dominates the pharmacy market both in demand and drug development. Researchers from FLANKE estimated that the U.S. makes up about 55% of medication sales, but only 24 per cent of sales volume. A solid system that rewards innovation and the improvement of current treatments ensure a supportive pharmaceutics markets for open public companies.

About 3 of the 10 top drug manufacturers of pharmaceutical drugs are based in Europe. Swiss hosts the top two drug producers; Roche and Novartis. The eighth rank is held by France’s Sanofi. Amongst the geographic marketplaces, Europe is the number one cedar of pharmaceutical drugs, with shipments in 2020 totaling US$328.4 billion which accounts for 80.5 per cent of the global total. The nations around the world experiencing the most growth in phrases of pharmacy export products are Slovenia, Ireland in Europe, India and Italia.

Europe is known for innovation as well, and there are many products in the R&D stages right now. One of the latest breakthrough enhancements to come out there of the region is Gavre to (pralsetinib) for the treatment of grownups with RET fusion-positive state-of-the-art non-small-cell lung cancer tumor, developed by Rocher. With such benefits India enjoys an important position in the global pharmaceutical drugs sector. This factor will strengthen India’s position in global pharmacy industry.

Our Free Sample Reports Includes:

- In-depth Industry Analysis, Introduction, Overview, and COVID-19 Pandemic Outbreak.

- Impact Analysis 180+ Pages Research Report (Including latest research).

- Provide chapter-wise guidance on request 2021 Updated Regional Analysis with Graphical Representation of Trends, Size, & Share, Includes Updated List of figures and tables.

Updated Report Includes Major Market Players with their Sales Volume, Business Strategy and Revenue Analysis by using Precedence Research methodology.

Download a FREE Sample Copy (Including TOC, List of Tables & Figures, and Chart) @ https://www.precedenceresearch.com/sample/1568

Pharmacy Market Type Scope

| Report Coverage | Details |

| Market Size | USD 1,627.74 Billion by 2030 |

| Growth Rate | CAGR of 4.7% from 2021 to 2030 |

| Base Year | 2021 |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Forecast Period | 2022 to 2030 |

Pharmacy Type Market Report Highlights

- The E-pharmacy segment is expected to grow with fastest CAGR in during the forecast time period. With the occurrence of COVID-19 pandemic, adoption of online pharmacies increased. Post-pandemic, consumers will continue adopting e-pharmacies because of benefits, such as affordability, accessibility, and convenience

- In 2020, the prescription product type segment had the highest revenue share of more than 80%.The rising prevalence of chronic diseases, as well as the ageing population, is pushing up prescription drug demand.

Pharmacy Type Market Dynamics

Driver

Availability of Health and Wellness services in Pharmacies Increasing Consumer Base of Pharmacies

Over the past few years established industry players have invested hugely in delivering innovative and superior service, while pharmacies are focusing significantly towards increasing customer satisfaction by offering health and wellness services. The key driver of overall customer satisfaction is the availability of overall wellness services. Supply of these services is showing improvement in overall customer satisfaction. These kinds of services are at present seen in 86% of chain drug stores, 83% of superstore pharmacies and 73% of mass merchandiser medical stores in U.S. Many pharmacies are focusing on on-time delivery through mail orders Customer satisfaction is highest when they get a health professional prescribed medicines ready/delivered when assured. Such innovative services provided by pharmacies are driving the market growth.

Restraint

Increasing competition From E-pharmacies to pose Major Threat for Retail Pharmacies

Competition in the pharmacy industry is projected to intensify in the approaching years, especially from big-box merchants and mail-order and online pharmacies. Payors also have piloted consumers email ordering, such as by covering a 3 month supply of medications sent to the home just a 30-day supply offered at a brick-and-mortar drug-store. Finally, Internet medical stores are aggressively focusing on cash-paying customers by providing medications at a lower cost.

The multinational companies such as Amazon entering in E-pharmacy segment is a menace to retail medical stores on multiple methodologies. Amazon entered into the health professional prescribed industry with their 2018 acquisition of PillPack and the 2020 launching of Amazon Pharmacy and an Amazon Excellent prescription discount profit. And furthermore Amazon is planning to create physical pharmacies. With such moves Amazon will still be a thorn in the side and tension on the underside line of list pharmacies. This factor may act as a major threat for the expansion of retail pharmacies.

Read Also: Metal Stamping Market Size Anticipated To Reach US$ 283 Bn By 2030

Opportunity

Innovations in Technology Evolving Pharmacy Industry

Innovation in technology may provide promising opportunities for the market growth of pharmacy market during forecast time period. For years, researchers have been working on smart mirrors that utilize advanced cameras and customer’s breadth to detect health variations and smart toilets. Several companies are testing and developing basic home health care bots, and elderly workers in Japan are already wearing exoskeletons to help them perform manual labor.

Smartphones are progressing to the point where they can be used as point-of-care and home health diagnostic tools for ailments including urinary tract infections6 and diabetic eye disease. Labs have created an ingestible origami robot that can be swallowed and controlled to, for example, patch a wound, and are experimenting with xenobots, programmable organisms made from frog stem cells that could deliver medicine. As pharmaceutical are innovating and competing in the growing pharmacy market planning, adapting, and investing for the future offers lucrative opportunities.

Challenge

Low Margins for Pharmacy Owners Challenging Growth in Sales Value

Retail pharmacies are likely to face downward stresses on their profitability. Compensation is tightening and costs are on the rise for everything from wages to rent to more cumbersome certification and licensing requirements. In addition, medical stores have found themselves pushed to purchase new technology and products that can help keep them up to date and competitive. All this contributes to constantly shrinking margins that threaten long-term stability.

Pharmacy Market Key Players

Some of the major players operating in the pharmacy industry are:

- CVS Health

- Boots Walgreens

- Cigna

- Walmart

- Kroger

- Rite Aid Corp.

- Lloyd Pharmacy

- Well Pharmacy

- Humana Pharmacy Solutions

- Matsumoto Kiyoshi

Segments Covered in the Report

By Product Type

- Prescription

- OTC

By Pharmacy Type

- Retail

- E-pharmacy

By Application

- Hospital-grade

- Personal Use

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or the Asia Pacific.

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333