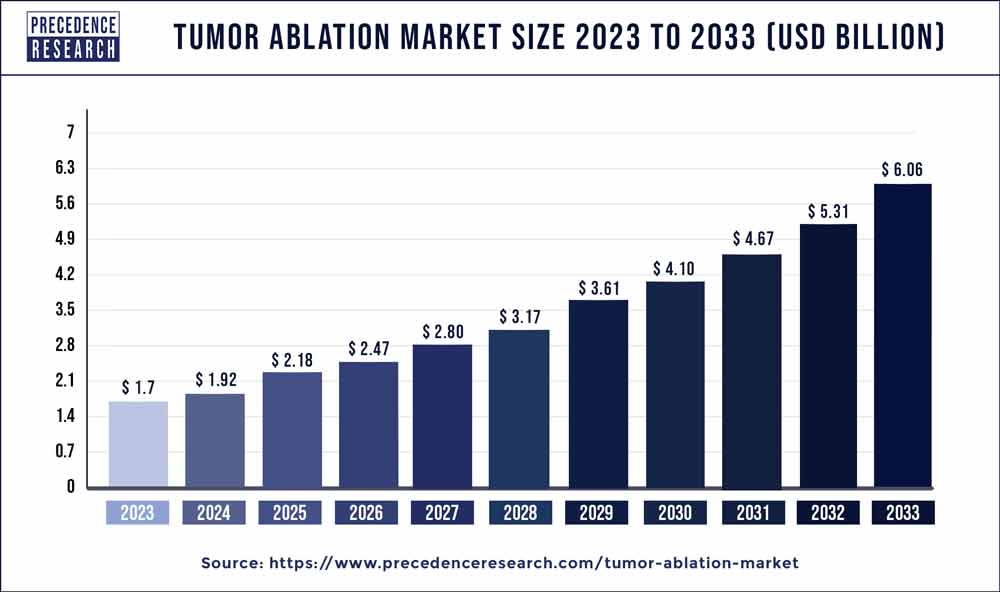

The global tumor ablation market size reached USD 1.7 billion in 2023 and is expected to grow around USD 6.06 billion by 2033, representing at a CAGR of 13.60% from 2024 to 2033.

Key Takeaways

- North America dominated the market while carrying 36% of the market share in 2023.

- Asia Pacific is expected to witness the fastest rate of growth in the tumor ablation market during the forecast period.

- By technology, the radio frequency ablation technology segment held the largest share of the tumor ablation market while carrying a of 34% share in 2023.

- By technology, the microwave ablation technology segment is expected to grow at the fastest rate during the forecast period.

- By treatment, the percutaneous ablation segment dominated the market with 56% market share in 2023.

The tumor ablation market has been witnessing significant growth in recent years due to the increasing prevalence of cancer worldwide. Tumor ablation refers to a minimally invasive procedure used to destroy cancerous cells or tumors within the body. This technique is gaining traction as an alternative to surgery, particularly for patients who are not eligible for surgical intervention or prefer less invasive treatment options. The market encompasses various technologies such as radiofrequency ablation (RFA), microwave ablation, cryoablation, and others, each offering unique advantages in terms of efficacy and safety.

Get a Sample: https://www.precedenceresearch.com/sample/3758

Growth Factors:

Several factors contribute to the growth of the tumor ablation market. Firstly, the rising incidence of cancer across the globe is a primary driver for the adoption of tumor ablation techniques. With cancer being one of the leading causes of mortality worldwide, there is an increasing demand for effective and less invasive treatment modalities. Additionally, advancements in ablation technologies, such as the development of next-generation ablation devices with improved precision and efficacy, are fueling market growth. Moreover, the growing preference for minimally invasive procedures among both patients and healthcare providers is driving the adoption of tumor ablation techniques over traditional surgical methods. Furthermore, the expanding applications of tumor ablation beyond oncology, such as in the treatment of benign tumors and palliative care, are opening up new avenues for market expansion.

Tumor Ablation Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 13.60% |

| Global Market Size in 2023 | USD 1.7 Billion |

| Global Market Size by 2033 | USD 6.06 Billion |

| U.S. Market Size in 2023 | USD 430 Million |

| U.S. Market Size by 2033 | USD 1,540 Million |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Technology, By Treatment, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Tumor Ablation Market Dynamics

Drivers:

Several drivers are propelling the growth of the tumor ablation market. Firstly, technological advancements in ablation devices are enabling more precise and targeted treatment, thereby improving patient outcomes and reducing the risk of complications. Additionally, the increasing adoption of minimally invasive procedures by healthcare providers is driving the demand for tumor ablation techniques, as they offer advantages such as shorter recovery times, reduced hospital stays, and lower healthcare costs compared to surgery. Moreover, the growing awareness among patients about the benefits of early cancer detection and treatment is driving the demand for tumor ablation procedures as part of comprehensive cancer management strategies. Furthermore, favorable reimbursement policies for ablation procedures in many countries are encouraging healthcare providers to incorporate these techniques into their treatment protocols, further driving market growth.

Restraints:

Despite the promising growth prospects, the tumor ablation market faces certain restraints that could impede its expansion. One of the primary challenges is the high cost associated with ablation procedures and devices, which may limit access for patients, particularly in developing countries with limited healthcare infrastructure. Moreover, the lack of skilled healthcare professionals trained in performing ablation procedures could hinder market growth, as these techniques require specialized expertise and training. Additionally, concerns regarding the long-term efficacy and safety of ablation techniques, especially in comparison to surgery and other conventional treatment modalities, may pose a challenge to market acceptance among healthcare providers and patients. Furthermore, regulatory challenges and stringent approval processes for new ablation devices could delay market entry and innovation, hampering overall market growth.

Opportunities:

Despite the challenges, the tumor ablation market presents significant opportunities for growth and innovation. Firstly, the increasing focus on personalized medicine and targeted therapies is creating opportunities for the development of novel ablation techniques tailored to individual patient profiles and tumor characteristics. Moreover, the integration of advanced imaging technologies, such as MRI and ultrasound guidance, into ablation procedures is enhancing treatment accuracy and expanding the scope of applications. Additionally, collaborations and partnerships between healthcare providers, medical device companies, and research institutions are fostering innovation and driving the development of next-generation ablation technologies. Furthermore, the growing adoption of telemedicine and remote monitoring solutions is creating opportunities for the expansion of tumor ablation services beyond traditional healthcare settings, particularly in remote and underserved areas.

Read Also: U.S. Asthma Drugs Market Size to Cross USD 13.76 Bn by 2033

Recent Developments

- In April 2023, Compal Electronics, a Taiwanese electronics company, unveiled a novel radiofrequency ablation (RFA) system designed for the percutaneous and intraoperative coagulation and ablation of soft tissue. This includes the partial or complete ablation of non-resectable liver lesions. Additionally, Compal Electronics introduced a bi-level ventilator targeting chronic obstructive pulmonary disease (COPD) and respiratory insufficiency resulting from central and/or mixed apneas.

- In March 2022, Quantum Surgical, a company specializing in ablation devices and other medical technologies, obtained FDA approval for Epione, a ground-breaking interventional oncology robotics system designed specifically for minimally invasive liver cancer treatment. The Epione system from Quantum Surgical facilitates the planning and execution of minimally invasive ablation surgery, allowing it to be performed as an outpatient procedure. The system achieves this by deploying computer-guided needles through the skin to precisely target and eliminate tumors.

- In September 2020, Boston Scientific Corporation disclosed the signing of an investment agreement that included an exclusive option to acquire Farapulse, Inc., a privately-held company engaged in the development of a pulsed field ablation (PFA) system for treating atrial fibrillation (AF) and other cardiac arrhythmias. The PFA system comprises a sheath, generator, and catheters, aiming to ablate heart tissue by creating a therapeutic electric field, contrasting with conventional thermal energy sources such as radiofrequency ablation or cryoablation.

Tumor Ablation Market Companies

- Boston Scientific Corporation (U.S.)

- Medtronic (U.S.)

- Olympus (Germany)

- Stryker (U.S.)

- Biotronik (Germany)

- Merit Medical Systems. (Utah)

- HealthTronics, Inc. (U.S.)

- Insightec. (Israel)

- AngioDynamics. (New York)

- Integra LifeSciences (U.S.)

- Bioventus LLC. (U.S.)

- Ethicon Inc. (A Subsidiary of Johnson & Johnson) (U.S.)

- EDAP TMS (Auvergne-Rhône-Alpes)

- Sonablate Corp. (U.S.)

- BVM Medical Limited (England)

- Terumo Europe NV (Belgium)

- IceCure Medical (Israel)

Segments Covered in the Report

By Technology

- Radiofrequency Ablation

- Microwave Ablation

- Cryoablation

- Irreversible Electroporation Ablation

- HIFU

- Other ablation technologies

By Treatment

- Surgical Ablation

- Laparoscopic Ablation

- Percutaneous Ablation

By Application

- Kidney Cancer

- Liver cancer

- Breast cancer

- Lung cancer

- Prostate cancer

- Other cancer

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/