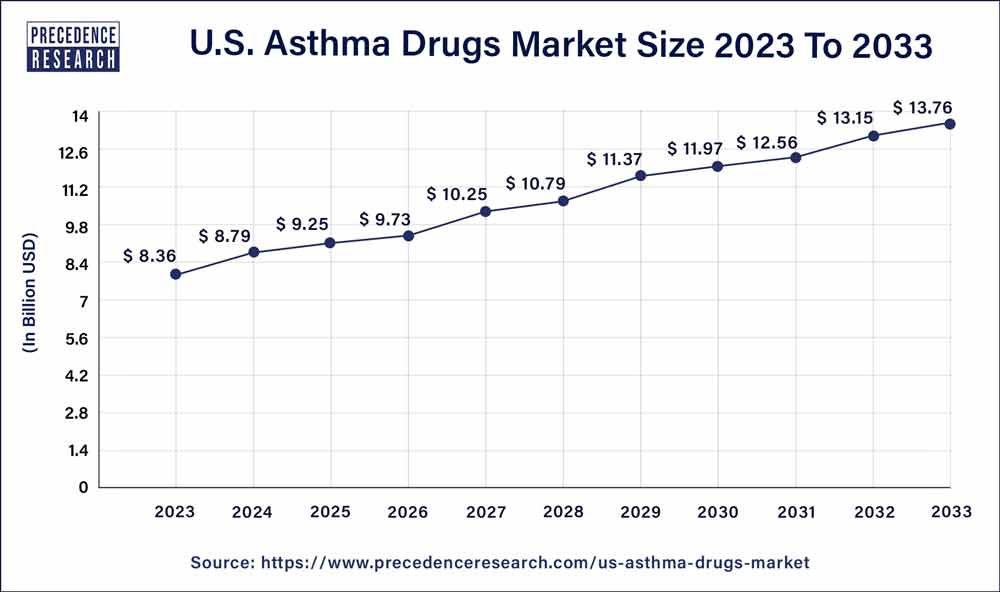

The U.S. asthma drugs market size reached USD 8.36 billion in 2023 and is expected to rake around USD 13.76 billion by 2033, growing at a CAGR of 5.11% from 2024 to 2033.

Key Takeaways

- By medication, the quick relief medications segment dominated the market in 2023, the segment is observed to witness a notable growth during the forecast period.

- By mode of administration, the inhalers segment dominated the U.S. asthma drugs market in 2023. The segment is observed to sustain the position during the forecast period.

- By organization type, the public segment is expected to sustain its dominance throughout the forecast period.

- By application, the adults segment was observed to dominate the U.S. asthma drugs market in 2023.

- By application, the pediatric segment is expected to show substantial growth during the forecast period.

The U.S. Asthma Drugs Market is a vital segment of the pharmaceutical industry, catering to the needs of millions of asthma patients across the country. Asthma is a chronic respiratory condition characterized by inflammation and narrowing of the airways, leading to symptoms like wheezing, coughing, chest tightness, and shortness of breath. The prevalence of asthma in the United States has been steadily increasing over the years, making it a significant public health concern. As a result, the demand for effective asthma drugs continues to rise, driving growth and innovation in the market.

Get a Sample: https://www.precedenceresearch.com/sample/3757

Growth Factors:

Several key factors contribute to the growth of the U.S. Asthma Drugs Market. Firstly, the increasing prevalence of asthma among both children and adults fuels the demand for pharmaceutical interventions. Factors such as air pollution, allergens, genetic predisposition, and lifestyle changes contribute to the rising incidence of asthma cases in the U.S. Additionally, advancements in medical technology and drug development have led to the introduction of novel therapeutic agents that offer improved efficacy and safety profiles compared to traditional treatments. Furthermore, the growing awareness about asthma management and the importance of adhering to prescribed medication regimens among patients and healthcare providers contribute to the expansion of the market.

U.S. Asthma Drugs Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 5.11% |

| U.S. Market Size in 2023 | USD 8.36 Billion |

| U.S. Market Size by 2033 | USD 13.76 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Medication, By Mode of Administration, By Source, By Organization Type, and By Application |

U.S. Asthma Drugs Market Dynamics

Drivers:

Several drivers propel the growth of the U.S. Asthma Drugs Market. One of the primary drivers is the increasing investment in research and development by pharmaceutical companies to develop innovative asthma treatments. These investments aim to address unmet medical needs, improve treatment outcomes, and enhance patient quality of life. Moreover, favorable government initiatives and policies aimed at promoting respiratory health, such as funding for asthma education programs and research grants, stimulate market growth. Additionally, strategic collaborations and partnerships between pharmaceutical companies, research institutions, and healthcare organizations facilitate the development and commercialization of new asthma drugs, driving market expansion further.

Restraints:

Despite the significant growth opportunities, the U.S. Asthma Drugs Market faces several restraints that may impede its growth trajectory. One of the primary restraints is the high cost associated with asthma medications, which can pose a financial burden on patients, particularly those without adequate insurance coverage. Additionally, regulatory challenges and stringent approval processes for new drug candidates can delay market entry and limit the availability of innovative treatments. Moreover, the presence of generic alternatives and the expiration of patents for certain asthma drugs can lead to pricing pressures and competition within the market, impacting profit margins for pharmaceutical companies.

Opportunities:

Despite the challenges, the U.S. Asthma Drugs Market presents several opportunities for growth and expansion. The increasing focus on personalized medicine and precision therapies opens up avenues for the development of targeted asthma treatments tailored to individual patient needs. Moreover, the rising adoption of biologic therapies, such as monoclonal antibodies, for severe asthma management offers a lucrative opportunity for pharmaceutical companies to innovate and diversify their product portfolios. Furthermore, the growing emphasis on preventive care and early intervention strategies presents opportunities for the development of novel asthma medications aimed at preventing exacerbations and reducing disease progression. Additionally, the expanding telemedicine and digital health landscape create new channels for delivering asthma care and support services to patients, enhancing accessibility and improving treatment adherence.

Read Also: Artificial Lights Market Size to Attain USD 123.69 Bn by 2033

Recent Developments

- In January 2023, in the United States, Airsupra (albuterol/budesonide), formerly known as PT027, received recognition as a preventive or as-needed treatment for bronchoconstriction, as well as to lower the risk of exacerbations in individuals with asthma who are 18 years of age or older. The FDA’s clearance was granted based on the outcomes of the Phase III studies for MANDALA and DENALI.

- In July 2023, the U.S. Food and Drug Administration approved the first generic version of AstraZeneca’s Symbicort®, BreynaTM (budesonide and formoterol fumarate dihydrate) Inhalation Aerosol. The drug is a result of a collaboration between Viatris Inc., a global healthcare company, and Kindeva Drug Delivery L.P. It is recommended for certain people who suffer from asthma or chronic obstructive pulmonary disease (COPD).

- In December 2023, an exclusive license agreement was announced to develop a potential novel antibody-based therapy for the treatment of asthma and atopic dermatitis by Teva Pharmaceutical Industries Ltd. and Biolojic Design Ltd., a biotechnology company that turns antibodies into intelligent medicinal solutions using computational biology and artificial intelligence.

U.S. Asthma Drugs Market Companies

- GlaxoSmithKline

- Pfizer

- Vectura Group

- Boehringer Ingelheim

- Roche

- Novartis

- Merck

- AstraZeneca

- Teva Pharmaceutical

Segments Covered in the Report

By Medication

- Quick Relief Medications

- Long-term Control Medications

- Others

By Mode of Administration

- Tablets and Capsules

- Liquids

- Inhalers

- Injections

- Sprays and Powders

By Source

- Environmental

- Generic

By Organization Type

- Public

- Private

By Application

- Pediatric

- Adults

- Adolescent

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/