List of Contents

ToggleKey Takeaways

- By procedure, the hyperbaric oxygen therapy segment held the largest share of 34% in 2023.

- By procedure, the specialized dressings segment is expected to capture the largest market share during the forecast period of 2024-2033.

- By type, the hospital segment dominated the U.S. wound care centers market in 2023 and the segment is observed to sustain the dominance throughout the forecast period.

Introduction:

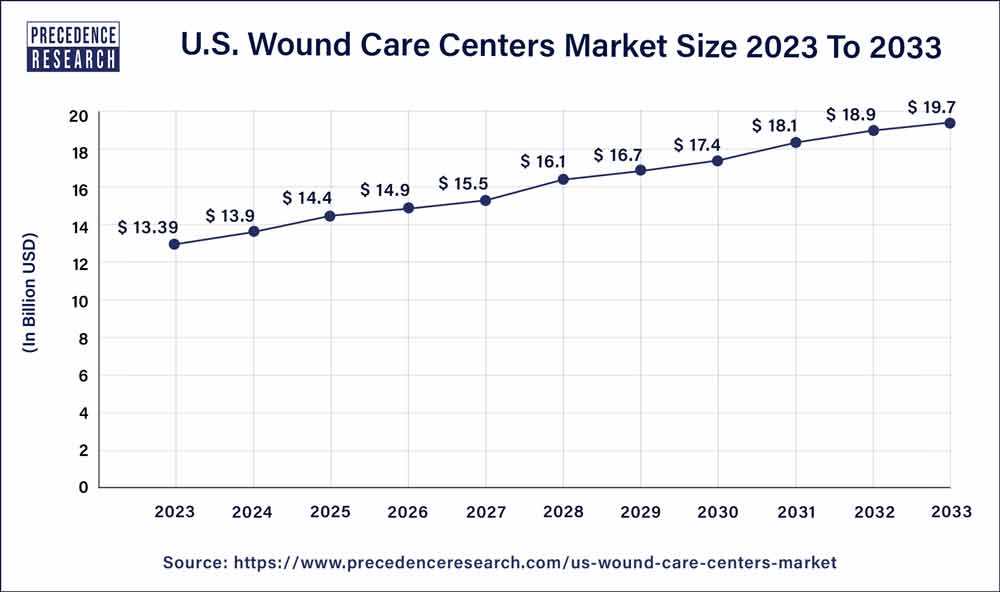

The U.S. wound care centers market is experiencing significant growth driven by an aging population, increasing prevalence of chronic wounds, and advancements in wound care technologies. Wound care centers play a critical role in managing complex wounds and promoting healing, offering specialized treatments and comprehensive care to patients across the country. As the demand for advanced wound care solutions continues to rise, the market for wound care centers in the United States is poised for continued expansion.

Get a Sample: https://www.precedenceresearch.com/sample/3727

Growth Factors:

Several factors are fueling the growth of the U.S. wound care centers market. The aging population is one of the primary drivers, as elderly individuals are more susceptible to chronic wounds such as pressure ulcers, diabetic foot ulcers, and venous leg ulcers. Additionally, the increasing prevalence of conditions such as diabetes and obesity contributes to the rising incidence of chronic wounds, driving demand for specialized wound care services. Moreover, advancements in wound care technologies, including innovative dressings, bioengineered skin substitutes, and negative pressure wound therapy systems, are enhancing treatment outcomes and expanding the range of available therapeutic options.

U.S. Wound Care Centers Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 5.06% |

| U.S. Market Size in 2023 | USD 1,468.72 Million |

| U.S. Market Size by 2033 | USD 2,390.89 Million |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Type and By Procedure |

U.S. Wound Care Centers Market Dynamics

Drivers:

The demand for wound care centers in the United States is driven by various factors, including the increasing incidence of chronic diseases, rising healthcare expenditures, and growing awareness of the importance of early wound intervention. Chronic conditions such as diabetes, peripheral vascular disease, and obesity are significant contributors to the development of chronic wounds, necessitating specialized care and management. Furthermore, the shift towards value-based healthcare models and emphasis on reducing hospital readmissions have spurred the establishment of wound care centers focused on providing comprehensive, patient-centered care. Government initiatives aimed at improving wound care quality and outcomes, such as reimbursement reforms and quality reporting programs, also drive the expansion of the market.

Restraints

Despite the growth opportunities, the U.S. wound care centers market faces certain challenges and restraints. Reimbursement issues, including declining reimbursement rates and complex billing processes, pose financial challenges for wound care providers. Additionally, shortages of qualified wound care professionals, including physicians, nurses, and specialized wound care therapists, limit the capacity of wound care centers to meet growing patient demand. Moreover, regulatory hurdles and compliance requirements add administrative burdens and increase operational costs for wound care facilities, impacting their profitability and sustainability.

Opportunity:

The U.S. wound care centers market presents significant opportunities for growth and innovation. With advancements in technology and treatment modalities, there is potential for the development of novel wound care products and therapies that improve healing outcomes and enhance patient comfort. Telemedicine and remote monitoring solutions offer opportunities to expand access to wound care services, particularly in underserved rural areas. Additionally, collaborations between wound care centers, healthcare systems, and research institutions can facilitate knowledge sharing, clinical research, and the development of best practices, driving continuous improvement in wound care delivery.

The U.S. wound care centers market is geographically diverse, with the distribution of facilities influenced by factors such as population demographics, healthcare infrastructure, and regional healthcare trends. Urban areas with higher population densities and greater healthcare resources tend to have a higher concentration of wound care centers, while rural and underserved areas may have limited access to specialized wound care services. However, efforts are underway to address healthcare disparities and improve access to wound care across all regions of the United States through initiatives such as telemedicine, mobile wound care clinics, and community outreach programs.

Read Also: Electric Diaphragm Pump Market Size to Cross USD 4.30 Bn by 2033

Recent Developments

- In November 2023, the Logan Memorial Hospital Wound Treatment Center, which will be open November 9, 2023, at 1623 Nashville Street, MOB 3 Suite 203 in Russellville, will provide advanced wound treatment to patients with constant, non-healing wounds. Logan Memorial Hospital and Healogics, the top supplier of sophisticated, chronic wound care treatments in the country, have joined. With its main office located in Jacksonville, Florida, Healogics operates a network of more than 600 Wound Care Centers® around the country.

- In May 2023, for those with chronic, non-healing wounds, OSF HealthCare Sacred Heart will establish a new wound care clinic on May 11th, providing advanced wound treatment. OSF HealthCare Sacred Heart has formed a partnership with Healogics, the top supplier of sophisticated, long-term wound care treatments in the country. The address of OSF Sacred Heart Wound Care is 812 N Logan Ave., which is on the hospital’s ground floor.

- In April 2023, as a pioneer in point-of-care fluorescence imaging for identifying and localizing increased bacterial loads in wounds, MolecuLight Corp. announced a collaboration with Perceptive Solutions to offer a cloud-based wound management solution through its WoundZoom® platform, which will be integrated with the MolecuLightDXTM point-of-care bacterial imaging device. At the SAWC (Symposium for the Advancement of Wound Care) Spring 2023 conference, which takes place in National Harbor, Maryland from April 27 to 29, 2023, the new alliance is being unveiled. In addition to showcasing their products and talking about the combined imaging–wound care solution, both businesses will be co-exhibiting (Perceptive Solutions/WoundZoom at booth #631; MolecuLight at booth #627).

U.S. Wound Care Centers Market Companies

- Hologic, Inc.

- Woundtech

- Wound Care Advantage, LLC

- Wound Care Specialists, LLC

- RestorixHealth

- DFW Wound Care Center

- Wound Providers of America

- American Wound Care

- WoundCentrics

- Wound Care Solutions, Inc.

Segments Covered in the Report

By Type

- Hospitals

- Clinics

By Procedure

- Debridement

- Negative Pressure Wound Therapy

- Compression Therapy

- Hyperbaric Oxygen Therapy

- Specialized Dressings

- Infection Control

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology (Premium Insights)

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Wound Care Centers Market

5.1. COVID-19 Landscape: U.S. Wound Care Centers Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Wound Care Centers Market, By Type

8.1. U.S. Wound Care Centers Market, by Type, 2024-2033

8.1.1. Hospitals

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Clinics

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Wound Care Centers Market, By Procedure

9.1. U.S. Wound Care Centers Market, by Procedure, 2024-2033

9.1.1. Debridement

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Negative Pressure Wound Therapy

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Compression Therapy

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Hyperbaric Oxygen Therapy

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Specialized Dressings

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. Infection Control

9.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Wound Care Centers Market and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Type (2021-2033)

10.1.2. Market Revenue and Forecast, by Procedure (2021-2033)

Chapter 11. Company Profiles

11.1. Hologic, Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Woundtech

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Wound Care Advantage, LLC

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Wound Care Specialists, LLC

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. Recent Initiatives

11.5. RestorixHealth

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. DFW Wound Care Center

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Wound Providers of America

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. American Wound Care

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. WoundCentrics

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Wound Care Solutions, Inc.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/