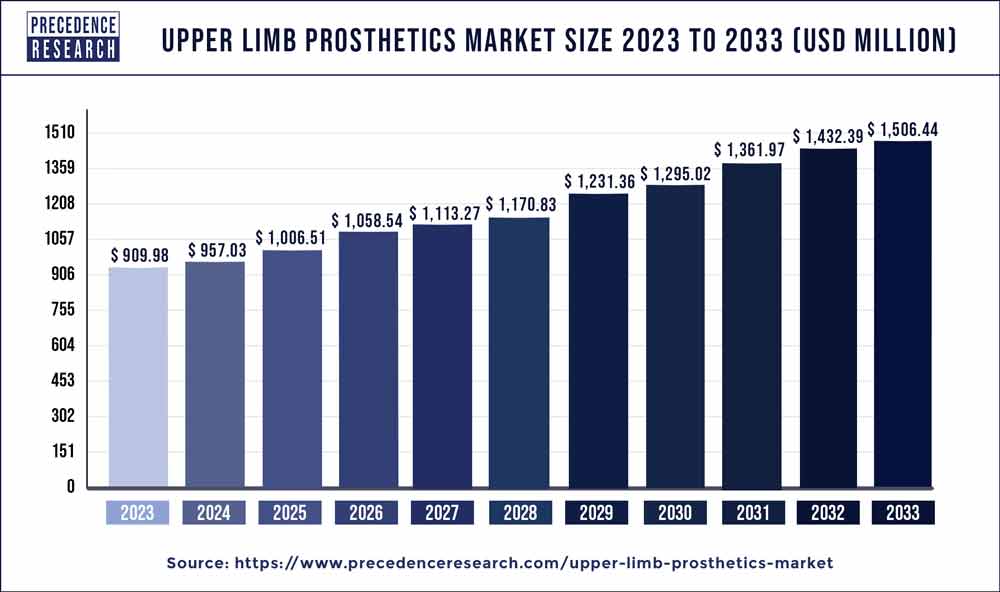

The global upper limb prosthetics market size surpassed USD 909.98 million in 2023 and is expected to grow around USD 1,506.44 million by 2033 with a CAGR of 5.17% from 2024 to 2033.

Key Points

- North America dominated the market with the largest market of 43% in 2023.

- Asia Pacific is projected to experience the highest growth during the forecast period.

- By component, the prosthetic arm segment dominated the market in 2023 and is expected to experience further growth over the forecast period.

- By component, the prosthetic wrist segment is poised for significant growth in the forecast period.

- By product, the passive prosthetic devices segment dominated the market with the largest share of 35% in 2023.

- By product, the body-powered prosthetic devices segment is expected to experience the fastest growth rate during the forecast period.

- By end-user, the prostetic clinics segment dominated the market in 2023.

- By end-user, the hospitals segment is poised for substantial growth throughout the forecast period.

The upper limb prosthetics market encompasses a wide array of devices designed to restore functionality and aesthetics to individuals who have lost one or both upper limbs due to congenital conditions, accidents, or medical conditions such as amputation. These prosthetic devices aim to mimic the form and function of natural limbs, allowing users to perform daily activities, engage in work, and participate in recreational pursuits with greater independence and confidence. The market for upper limb prosthetics has witnessed significant advancements in recent years, driven by technological innovations, improvements in materials and manufacturing techniques, and a growing emphasis on personalized solutions tailored to individual patient needs.

Get a Sample: https://www.precedenceresearch.com/sample/3882

List of Contents

ToggleGrowth Factors

Several key factors contribute to the growth of the upper limb prosthetics market. One of the primary drivers is the increasing incidence of limb loss due to factors such as traumatic injuries, vascular diseases, and cancer. As the global population ages and the prevalence of chronic health conditions rises, the demand for upper limb prosthetic devices is expected to escalate. Additionally, advancements in prosthetic technology, such as myoelectric prostheses controlled by muscle signals or neural interfaces, have significantly enhanced the functionality and usability of upper limb prosthetics, driving adoption rates among amputees. Furthermore, growing awareness about the importance of rehabilitation and prosthetic services, coupled with improvements in healthcare infrastructure in emerging markets, is expanding access to prosthetic care for individuals in need.

Upper Limb Prosthetics Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 5.17% |

| Global Market Size in 2023 | USD 909.98 Million |

| Global Market Size by 2033 | USD 1,506.44 Million |

| U.S. Market Size in 2023 | USD 293.47 Million |

| U.S. Market Size by 2033 | USD 485.83 Million |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Component, By Product Type, and By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Upper Limb Prosthetics Market Dynamics

Drivers

Several drivers propel the growth of the upper limb prosthetics market. Technological advancements, such as the integration of robotics, artificial intelligence, and 3D printing, have revolutionized prosthetic design and manufacturing processes, resulting in more lightweight, durable, and customizable devices. Additionally, increasing investments in research and development by both public and private sectors have led to the introduction of innovative prosthetic solutions with enhanced functionality, comfort, and aesthetics. Moreover, favorable reimbursement policies and government initiatives aimed at improving access to prosthetic care have facilitated the adoption of advanced upper limb prosthetics among patients worldwide. The growing acceptance of prosthetic devices in mainstream society and initiatives to promote inclusivity and accessibility for persons with disabilities further drive market growth.

Opportunities

The upper limb prosthetics market presents numerous opportunities for manufacturers, healthcare providers, and other stakeholders. Expanding product portfolios to cater to diverse patient needs, including pediatric, adult, and geriatric populations, can unlock new growth avenues. Additionally, partnerships and collaborations between prosthetic manufacturers, rehabilitation centers, and research institutions can facilitate the development of innovative technologies and solutions. Leveraging digital health technologies such as telehealth, remote monitoring, and virtual rehabilitation platforms can enhance patient engagement and improve outcomes. Furthermore, targeting emerging markets with unmet needs for prosthetic care and investing in education and training programs for healthcare professionals can help increase awareness and adoption of upper limb prosthetic devices globally.

Challenges

Despite the significant progress made in the field of upper limb prosthetics, several challenges persist. One of the primary challenges is the high cost associated with advanced prosthetic devices, which can limit access for individuals from lower-income backgrounds or regions with limited healthcare resources. Regulatory hurdles and reimbursement constraints in some countries may also impede market growth and innovation. Moreover, achieving optimal functionality and comfort with prosthetic devices remains a complex and ongoing process, requiring comprehensive rehabilitation and support services. Issues such as socket discomfort, skin irritation, and limited battery life in electronic prostheses can pose challenges for users and healthcare providers. Additionally, addressing psychosocial factors such as body image concerns, stigma, and psychological adjustment to limb loss remains an important aspect of holistic prosthetic care.

Region

The upper limb prosthetics market exhibits regional variations in terms of market size, technological adoption, reimbursement policies, and healthcare infrastructure. North America and Europe represent the largest markets for upper limb prosthetics, driven by high healthcare expenditure, advanced medical technology, and robust reimbursement systems. The Asia-Pacific region is poised for significant growth due to rising healthcare investments, increasing awareness about prosthetic care, and a large population of individuals with limb loss. Emerging markets in Latin America, the Middle East, and Africa offer untapped opportunities for market expansion, although challenges related to healthcare access, affordability, and regulatory frameworks persist in some regions. Collaboration between international organizations, governments, and non-profit organizations is essential to address these challenges and improve access to quality prosthetic care on a global scale.

Read Also: DNA Repair Drugs Market Size to Hit USD 27.45 Billion by 2033

Recent Developments

- In September 2023, Össur’s upper limb research and development (R&D) facility secured funding from Scottish Enterprise to develop new solutions in upper limb prosthetics.

- In May 2022, Ottobock SE & Co. KGaA showcased its Myo Plus T.H. upper limb prosthetic device at OTWorld in Leipzig. Ottobock anticipates introducing and demonstrating the Myo Plus T.H. upper limb prosthetic device, enhancing treatment possibilities and advancing market readiness.

Upper Limb Prosthetics Market Companies

- Össur

- Ottobock

- Steeper Group.

- Fillauer LLC

- Open Bionics

- Comprehensive Prosthetics & Orthotics

- COAPT LLC.

- Mobius Bionics.

- Protonix

- Motorica

Segments Covered in the Report

By Component

- Prosthetic Arm

- Prosthetic Elbow

- Prosthetic Wrist

- Prosthetic Shoulder

- Others

By Product Type

- Passive Prosthetic Devices

- Body Powered Prosthetic Devices

- Myoelectric Prosthetic Devices

- Hybrid Prosthetic Devices

By End-user

- Hospitals

- Prosthetic Clinics

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/