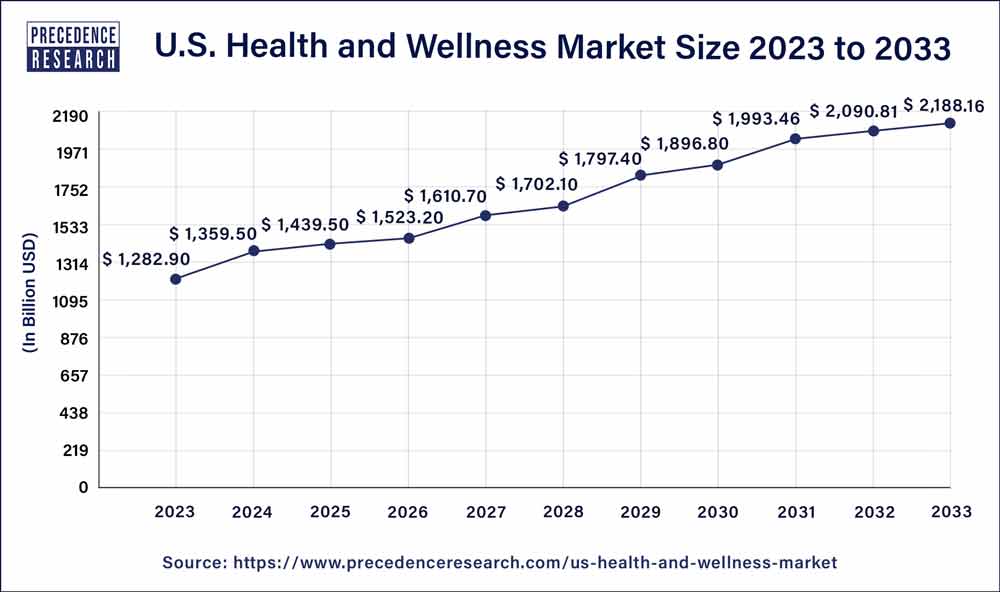

The US health and wellness market size reached USD 1,282.90 billion in 2023 and is projected to surpass around USD 2,188.16 billion by 2033 with a CAGR of 5.43% from 2024 to 2033.

The United States health and wellness market is a multifaceted sector encompassing various industries aimed at promoting physical and mental well-being among consumers. With a growing emphasis on preventive healthcare and lifestyle management, this market has witnessed significant expansion in recent years. From fitness and nutrition to alternative medicine and personal care, the health and wellness industry in the US caters to diverse consumer needs, driving innovation and market growth. This comprehensive overview seeks to explore the key factors influencing the growth and development of the US health and wellness market, including drivers, opportunities, and challenges inherent in the sector.

Get a Sample: https://www.precedenceresearch.com/sample/3883

Growth Factors:

Several factors contribute to the robust growth of the health and wellness market in the United States. Firstly, increasing health consciousness among consumers has spurred demand for products and services that promote overall well-being. With rising awareness about the importance of diet, exercise, and mental health, individuals are seeking out solutions to support their wellness goals. Moreover, technological advancements have revolutionized the health and wellness landscape, facilitating the development of innovative products such as wearable fitness trackers, telemedicine services, and personalized nutrition apps. Additionally, demographic trends, such as an aging population and growing prevalence of chronic diseases, have fueled demand for healthcare solutions focused on prevention and management.

US Health and Wellness Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 5.43% |

| U.S. Market Size in 2023 | USD 1,282.90 Billion |

| U.S. Market Size by 2033 | USD 2,188.16 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Sector |

US Health and Wellness Market Dynamics

Drivers:

Numerous drivers propel the expansion of the US health and wellness market, shaping its trajectory and influencing consumer behavior. One of the primary drivers is shifting consumer preferences towards natural and organic products. Increasingly, consumers are opting for organic food, herbal supplements, and clean beauty products, driven by concerns about synthetic ingredients and environmental sustainability. Additionally, the rising prevalence of lifestyle-related health conditions, such as obesity, diabetes, and stress-related disorders, has prompted individuals to prioritize preventive healthcare measures and adopt healthier lifestyles. Furthermore, corporate wellness programs and employer-sponsored health initiatives have gained traction as companies recognize the importance of promoting employee well-being to enhance productivity and reduce healthcare costs.

Opportunities:

Despite the challenges facing the US health and wellness market, numerous opportunities exist for businesses to innovate and capitalize on emerging trends. One significant opportunity lies in the digital health space, where technology-enabled solutions are transforming healthcare delivery and patient engagement. Telehealth services, remote monitoring devices, and digital therapeutics offer convenient and accessible options for consumers to manage their health and wellness remotely. Moreover, there is a growing demand for personalized wellness solutions tailored to individual preferences and health goals. Companies that leverage data analytics and artificial intelligence to deliver personalized recommendations and interventions stand to gain a competitive edge in the market. Additionally, partnerships and collaborations between traditional healthcare providers, technology companies, and wellness brands present opportunities to create integrated solutions that address holistic health needs.

Challenges:

Despite the promising growth prospects, the US health and wellness market faces several challenges that could hinder its expansion. One significant challenge is the fragmented nature of the industry, characterized by diverse stakeholders operating in silos. Fragmentation can lead to inefficiencies in healthcare delivery, inconsistent quality standards, and barriers to interoperability among digital health solutions. Additionally, regulatory uncertainty and compliance burdens pose challenges for companies navigating the complex regulatory landscape governing health and wellness products and services. Moreover, disparities in access to healthcare and wellness resources persist, disproportionately affecting underserved communities and exacerbating health inequities across socioeconomic groups.

The United States health and wellness market is characterized by regional variations in consumer preferences, healthcare infrastructure, and regulatory environments. In major metropolitan areas, such as New York City, Los Angeles, and San Francisco, a strong culture of health and wellness prevails, driving demand for premium products and services catering to affluent consumers. These urban hubs also serve as incubators for health and wellness startups and innovative wellness concepts, fueling entrepreneurship and market dynamism. However, rural areas and underserved communities face challenges in accessing healthcare services and wellness resources, highlighting the need for targeted interventions to address health disparities and promote equitable access to care.

Read Also: Upper Limb Prosthetics Market Size to Cross USD 1506.44 Bn by 2033

Recent Developments

- In February 2022, LifeSpeak acquired Wellbeats, a U.S.-based on-demand B2B physical wellbeing platform.

- In July 2023, WM Partners announced the acquisition of Allergy Research Group.

- In March 2023, NMS Capital announced that it had partnered with the management of Health & Wellness Partners Group, LLC (HWP) in the recapitalization of the company.

- In September 2023, Lucy Scientific Discovery announced the acquisition of BlueSky Wellness.

- In November 2022, Johnson & Johnson acquired Abiomed through a tender offer.

- In December 2022, HUL made strategic investments in ‘OZiva’ and ‘Wellbeing Nutrition’.

US Health and Wellness Market Companies

- Amway Corp.

- Herbalife Nutrition Ltd.

- Procter & Gamble

Segments Covered in the Report

By Sector

- Personal Care & Beauty & Anti-Aging

- Nutrition & Weight Loss

- Physical Activity

- Wellness Tourism

- Preventive & Personalized Medicine

- Spa Economy

- Others

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/