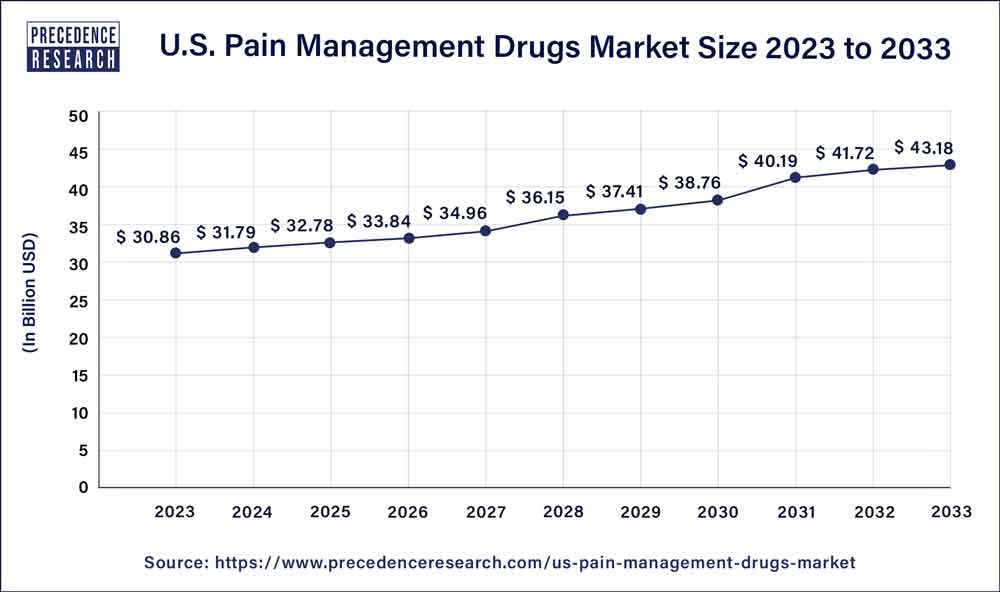

The US pain management drugs market size reached USD 30.86 billion in 2023 and is projected to be worth around USD 43.18 billion by 2033 with a CAGR of 3.46% from 2024 to 2033.

Key Points

- By drug class, the opioids segment is expected to dominate the market over the forecast period.

- By indication, the arthritic pain segment is expected to capture the largest market share during the forecast period.

- By distribution channel, the hospital pharmacy segment held the largest share of the market in 2023. The segment is observed to sustain the position throughout the predicted timeframe.

The United States pain management drugs market is a significant component of the pharmaceutical industry, catering to the needs of millions of Americans who suffer from acute and chronic pain conditions. This overview aims to provide insights into the landscape of pain management drugs in the US, including market size, key players, growth drivers, opportunities, and challenges.

Get a Sample: https://www.precedenceresearch.com/sample/3839

Market Size and Scope

The US pain management drugs market encompasses a wide range of pharmaceutical products aimed at alleviating pain associated with various conditions, including musculoskeletal disorders, neuropathic pain, cancer, and postoperative pain. With an aging population and a growing prevalence of chronic diseases, the demand for effective pain management solutions continues to rise, driving market expansion.

According to recent market research reports, the US pain management drugs market is valued at billions of dollars annually, with projections indicating sustained growth in the coming years. Factors such as increasing healthcare expenditure, rising awareness about pain management options, and advancements in pharmaceutical research contribute to market growth.

Key Players and Market Dynamics:

The market for pain management drugs in the US is highly competitive, with numerous pharmaceutical companies vying for market share. Key players in the industry include multinational pharmaceutical giants, as well as smaller biotech firms specializing in pain therapeutics. These companies invest heavily in research and development to innovate new drugs and improve existing formulations, enhancing their competitive edge in the market.

Market dynamics in the US pain management drugs sector are influenced by factors such as drug efficacy, safety profiles, pricing strategies, and regulatory frameworks. The introduction of novel pain management therapies, including non-opioid analgesics, biologics, and medical cannabis products, is reshaping the market landscape and challenging traditional pain management approaches dominated by opioids.

Growth Drivers:

Several factors drive growth in the US pain management drugs market. One of the primary drivers is the rising prevalence of chronic pain conditions, such as arthritis, back pain, and neuropathy, among the aging population. As people live longer and face age-related health issues, the demand for effective pain relief medications continues to increase, fueling market growth.

Moreover, technological advancements and scientific innovations in pain research contribute to the development of novel therapeutic agents with improved efficacy and safety profiles. From targeted drug delivery systems to personalized medicine approaches, emerging technologies hold promise for addressing unmet needs in pain management and expanding treatment options for patients.

Opportunities:

Despite challenges such as regulatory scrutiny and public health concerns surrounding opioid misuse and addiction, the US pain management drugs market presents opportunities for innovation and growth. Investments in research and development aimed at discovering non-addictive analgesic agents, alternative pain management modalities, and complementary therapies offer avenues for pharmaceutical companies to differentiate their products and capture market share.

Furthermore, partnerships and collaborations between pharmaceutical companies, academic institutions, and healthcare providers facilitate the translation of scientific discoveries into clinical practice, accelerating the development and commercialization of novel pain management solutions. Additionally, the growing trend towards holistic approaches to pain management, including integrative medicine and multimodal therapies, opens up new market opportunities for pharmaceutical companies to develop combination therapies and adjunctive treatments.

Challenges:

The US pain management drugs market also faces challenges that warrant attention from stakeholders. Concerns about the misuse, abuse, and diversion of opioid medications have prompted regulatory agencies to implement stricter prescribing guidelines and risk mitigation strategies, impacting the prescribing patterns and market dynamics for opioid analgesics.

Moreover, healthcare reimbursement policies, formulary restrictions, and pricing pressures pose challenges for pharmaceutical companies seeking market access and reimbursement for their pain management drugs. The evolving regulatory landscape, including drug approval processes, labeling requirements, and post-marketing surveillance, adds complexity to the commercialization pathway for pain therapeutics.

Read Also: Virtual Sports Market Size to Worth USD 77.07 Billion by 2033

Recent Developments

- In May 2023, Zoetis Inc. announced that LibrelaTM (bedinvetmab injectable) has been authorized by the U.S. Food and Drug Administration (FDA) for the management of pain in dogs suffering from osteoarthritis (OA). The first and only monthly anti-NGF monoclonal antibody medication for canine OA pain is called Librela, and it is both safe and effective in managing dogs’ OA pain symptoms over the long term, which can enhance their mobility and general quality of life.

US Pain Management Drugs Market Companies

- Teva Pharmaceutical

- Pfizer

- Abbott

- Mallinckrodt Pharmaceuticals

- Endo International

- GlaxoSmithKline

- AstraZeneca

- Depomed

- Merck

- Novartis

Segments Covered in the Report

By Drug Class

- NSAIDs

- Opioids

- Anesthetics

- Antidepressants

- Anticonvulsants

- Others

By Indication

- Arthritic Pain

- Neuropathic Pain

- Chronic Back Pain

- Post-Operative Pain

- Cancer Pain

- Others

By Distribution Channel

- Online Pharmacy

- Retail Pharmacy

- Hospital Pharmacy

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/