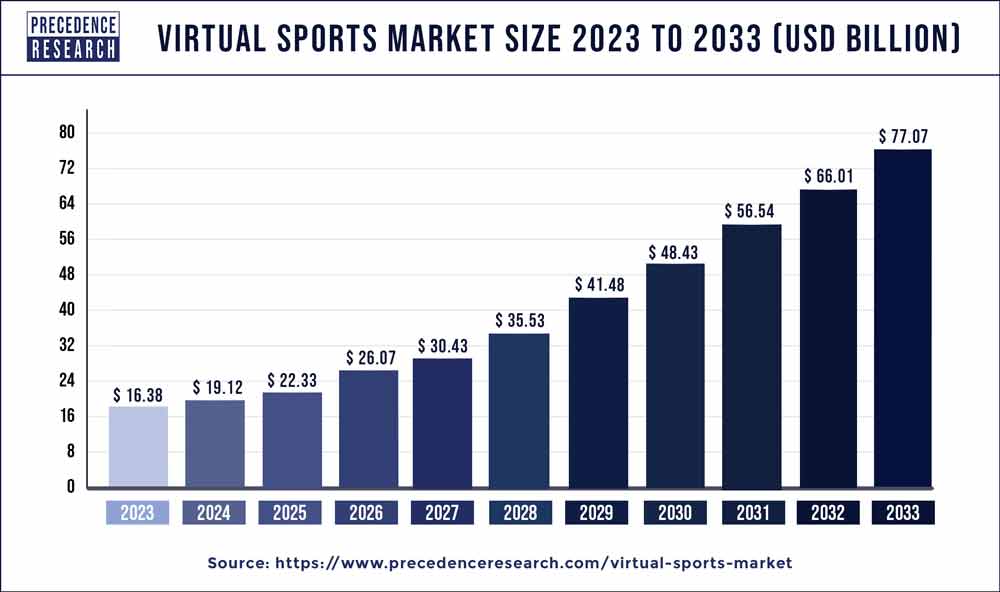

The global virtual sports market size was valued at USD 16.38 billion in 2023 and is expected to rake around USD 77.07 billion by 2033 with a CAGR of 16.75% from 2024 to 2033.

Key Points

- North America held the largest share of the market in 2023.

- Asia Pacific is expected to witness the fastest CAGR of 19.07% during the forecast period.

- By component, the solution segment held the largest segment of 86% in 2023.

- By component, the services segment is expected to grow at a significant rate during the forecast period.

- By game, the football virtual sports segment held the largest market share of 30% in 2023.

- By game, the basketball virtual sports segment is expected to grow at a notable rate.

- By demographic, the 21 to 35 years segment has contributed more than 42% of revenue share in 2023.

- By demographic, the below 21 years segment is expected to grow at a notable CAGR of 17.05% during the forecast period.

The virtual sports market has emerged as a dynamic sector at the intersection of technology and entertainment. With advancements in virtual reality (VR), augmented reality (AR), and gaming platforms, virtual sports have gained traction among audiences worldwide. This analysis aims to delve into the trends, growth factors, opportunities, and challenges shaping the virtual sports market.

Get a Sample: https://www.precedenceresearch.com/sample/3838

Trends

One of the prominent trends in the virtual sports market is the growing adoption of immersive technologies such as VR and AR. These technologies offer users an interactive and lifelike gaming experience, blurring the lines between the virtual and real worlds. From virtual soccer and basketball to simulated racing and esports tournaments, immersive virtual sports experiences are captivating audiences and driving engagement.

Another trend is the convergence of sports and esports. Traditional sports leagues and organizations are increasingly embracing esports as a way to engage younger audiences and expand their reach. Virtual versions of popular sports games, such as FIFA and NBA 2K, have become esports phenomena, attracting millions of viewers and lucrative sponsorship deals. This trend highlights the growing synergy between physical and virtual sports entertainment.

Moreover, the rise of mobile gaming has contributed to the popularity of virtual sports among casual gamers and esports enthusiasts alike. Mobile devices offer convenient access to a wide range of virtual sports experiences, from casual mobile games to competitive multiplayer titles. The accessibility and portability of mobile gaming have democratized access to virtual sports, driving widespread adoption and revenue growth.

Growth Factors

Several factors drive growth in the virtual sports market. Technological advancements, particularly in graphics rendering, motion tracking, and multiplayer networking, have elevated the quality and realism of virtual sports experiences. Enhanced graphics and immersive gameplay experiences attract gamers and sports enthusiasts alike, driving demand for virtual sports content and platforms.

Furthermore, the proliferation of high-speed internet connectivity and the widespread adoption of gaming consoles, PCs, and mobile devices have expanded the addressable market for virtual sports. With more people gaining access to digital gaming platforms, the potential audience for virtual sports content continues to grow, creating opportunities for developers, publishers, and content creators.

Additionally, the growing popularity of esports and online streaming platforms has contributed to the growth of the virtual sports market. Esports tournaments featuring virtual sports titles attract millions of viewers worldwide, driving advertising, sponsorship, and media rights revenue. Online streaming platforms such as Twitch and YouTube Gaming provide a platform for gamers to showcase their skills and engage with audiences in real-time, further fueling the growth of virtual sports content consumption.

Opportunities:

The virtual sports market presents numerous opportunities for stakeholders across the value chain. Content developers and publishers can capitalize on the growing demand for virtual sports experiences by creating compelling gameplay experiences and expanding their portfolio of virtual sports titles. Moreover, partnerships with sports leagues, teams, and athletes can enhance the authenticity and appeal of virtual sports content, attracting a broader audience base.

Furthermore, there are opportunities for innovation in virtual sports technology, including the development of new VR and AR applications, motion capture systems, and multiplayer gaming platforms. By investing in research and development, companies can stay ahead of the curve and deliver cutting-edge virtual sports experiences that captivate audiences and drive revenue growth.

Additionally, there are opportunities for brands and advertisers to engage with consumers through virtual sports sponsorships, in-game advertising, and branded content integrations. Virtual sports platforms offer a targeted and interactive way for brands to reach their target audience and drive brand awareness, affinity, and purchase intent.

Challenges:

Despite the growth potential, the virtual sports market also faces several challenges. One challenge is the high cost of developing and marketing virtual sports titles, particularly for smaller indie developers and studios. The competitive nature of the gaming industry and the need to deliver high-quality content pose barriers to entry for newcomers, limiting diversity and innovation in the market.

Moreover, concerns around data privacy and security pose challenges for virtual sports platforms and online gaming communities. With the increasing digitization of sports and gaming experiences, protecting user data and ensuring a safe and secure online environment is paramount. Companies must invest in robust cybersecurity measures and adhere to stringent data protection regulations to mitigate risks and build trust among users.

Furthermore, the fragmented nature of the virtual sports market and the proliferation of gaming platforms pose challenges for developers and publishers seeking to reach a broad audience. Platform exclusivity deals, licensing agreements, and compatibility issues can limit the availability of virtual sports content across different platforms, creating friction for gamers and hindering market growth.

Read Also: Soda Maker Market Size to Surpass USD 2,580 Million by 2033

Recent Developments

- In June 2023, One Future Football (1FF) launched its virtual worldwide soccer league to attract soccer fans. It has more than 250 CGI generated players and 12 founding member teams around the world.

- In June 2023, Big Ant Studios announced its partnership with NACON to launch date of Cricket 24 for Xbox Series X|S, PS4, PS5, Xbox One, and PC. It will feature the biggest rivalry in cricke, The Ashes. The game will also include nations and teams globally.

- In June 2023, Nike partnered with EA Sports to unravel unparalleled levels of customisation within the EA Sports ecosystem and provide immersive experiences.

- In April 2023, SEGA Corporation announced the acquisition of Rovio Entertainment Oyj. With the help of acquisition the company help to quicken the growth in the gaming market and rise its corporate value by creating synergies between Rovio’s strengths and SEGA’s current businesses, such as its live-operated mobile game and global IPs development capabilities.

Virtual Sports Market Companies

Key players focus on improving the realism of virtual sports simulations by incorporating cutting-edge technologies such as advanced graphics, artificial intelligence, and virtual or augmented reality in recent years. A few of these prominent players are:

- 2K Sports

- Activision Blizzard

- Big Ant Studios

- Codemasters

- Cyanide Studio

- Dovetail Games

- EA Sports

- HB Studios

- Konami

- Milestone S.r.l.

- Netmarble

- Nintendo

- Square Enix

- SEGA

- Sports Interactive

- Red Entertainment

- Ubisoft

- Visual Concepts

Segments Covered in the Report

By Component

- Solutions

- Services

By Game

- Football

- Racing

- Golf

- Basketball

- Cricket

- Skiing

- Tennis

- MMA

- Others

By Demographic

- Below 21 Years

- 21 to 35 Years

- 35 to 54 Years

- 54 Years and Above

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/