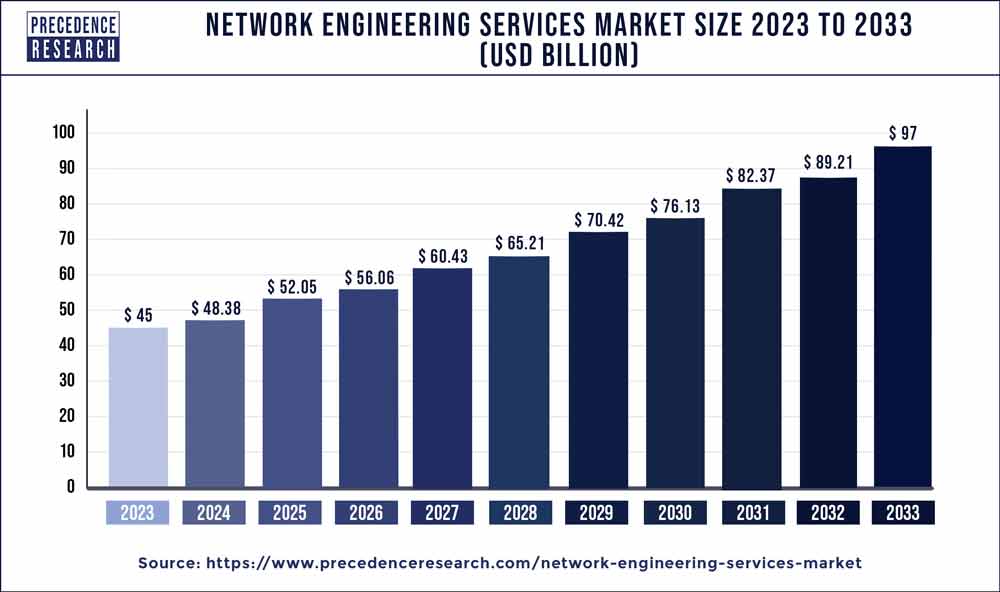

The global network engineering services market size was estimated at USD 45 billion in 2023 and is anticipated to rake around USD 97 billion by 2033, growing at a CAGR of 8% from 2024 to 2033.

Key Points

- North America contributed more than 32% of market share in 2023.

- Asia-Pacific is estimated to expand the fastest CAGR between 2023 and 2032.

- By service type, the professional services segment has held the largest market share of 62% in 2023.

- By service type, the managed services segment is anticipated to grow at a remarkable CAGR of 18.7% between 2024 and 2033.

- By connection type, the wired segment generated over 58% of the market share in 2023.

- By connection type, the wireless segment is expected to expand at the fastest CAGR over the projected period.

- By end-user, the communication service providers segment generated over 66% of the market share in 2023.

- By end-user, the enterprises segment is expected to expand at the fastest CAGR over the projected period.

Introduction:

The network engineering services market plays a pivotal role in the modern digital landscape, facilitating the seamless functioning of communication networks that underpin virtually every aspect of our interconnected world. These services encompass a broad spectrum of expertise, ranging from designing and implementing network infrastructures to optimizing and maintaining their performance. As businesses and organizations increasingly rely on complex networks to support their operations, the demand for specialized network engineering services continues to grow. This growth is driven by factors such as technological advancements, the proliferation of digital transformation initiatives, and the evolving needs of a globally connected society.

Growth Factors:

Several key factors contribute to the growth of the network engineering services market. Firstly, the rapid pace of technological innovation fuels demand for expertise in emerging networking technologies such as 5G, Internet of Things (IoT), software-defined networking (SDN), and cloud computing. Organizations seek out specialized services to navigate the complexities of these technologies and harness their full potential to drive efficiency and innovation.

Furthermore, the increasing digitization of businesses across industries drives the need for robust and secure network infrastructures. As companies transition towards digital-first strategies, they require tailored network solutions that can accommodate their unique requirements while ensuring scalability, reliability, and security.

Moreover, the proliferation of remote work and the rise of mobile computing have transformed the traditional workplace paradigm, necessitating agile and resilient network architectures. Network engineering services providers play a crucial role in enabling remote connectivity, optimizing network performance, and implementing cybersecurity measures to safeguard sensitive data in an increasingly distributed work environment.

Additionally, the globalization of markets and the expansion of multinational corporations have heightened the demand for network engineering services on a global scale. As businesses seek to establish and maintain connectivity across geographically dispersed locations, they rely on expert network engineers to design and manage complex wide-area networks (WANs) that facilitate seamless communication and collaboration.

Network Engineering Services Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 8% |

| Global Market Size in 2023 | USD 45 Billion |

| Global Market Size by 2033 | USD 97 Billion |

| U.S. Market Size in 2023 | USD 10.08 Billion |

| U.S. Market Size by 2033 | USD 21.86 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Service Type, By Connection Type, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Network Engineering Services Market Dynamics

Drivers:

Several drivers propel the growth of the network engineering services market. Firstly, the escalating volume of data generated by connected devices, applications, and digital services necessitates scalable and high-performance network infrastructures capable of handling increased bandwidth demands. This drives organizations to invest in network engineering services to upgrade their existing infrastructures or deploy new solutions that can accommodate growing data traffic.

Moreover, the growing threat landscape characterized by cyberattacks, data breaches, and other security vulnerabilities underscores the importance of robust cybersecurity measures within network infrastructures. Organizations enlist the expertise of network engineering services providers to implement advanced security solutions, conduct vulnerability assessments, and develop proactive strategies to mitigate risks and safeguard critical assets.

Furthermore, the shift towards cloud computing and hybrid IT environments presents both opportunities and challenges for organizations seeking to optimize their network architectures. Network engineering services play a crucial role in designing and implementing cloud-ready infrastructures, facilitating seamless integration with public, private, and hybrid cloud environments, and ensuring optimal performance, scalability, and security.

Additionally, the proliferation of digital transformation initiatives across industries drives the need for agile and adaptable network infrastructures that can support evolving business requirements. Network engineering services providers assist organizations in modernizing their legacy infrastructures, embracing automation and orchestration technologies, and adopting agile networking principles to enhance operational efficiency and innovation.

Restraints:

Despite the promising growth prospects, the network engineering services market faces several constraints that may impede its expansion. One such restraint is the shortage of skilled network engineers with expertise in emerging technologies such as 5G, SDN, and IoT. The rapid evolution of networking technologies necessitates continuous upskilling and professional development, which poses challenges for organizations in terms of recruiting and retaining qualified talent.

Moreover, budgetary constraints and cost considerations may limit the ability of organizations to invest in comprehensive network engineering services. In an increasingly competitive business environment, organizations may prioritize short-term cost savings over long-term investments in network infrastructure and services, leading to underinvestment in critical areas such as cybersecurity, performance optimization, and scalability.

Furthermore, regulatory compliance requirements and data privacy regulations impose additional constraints on organizations seeking to deploy network engineering services. Compliance with regulations such as GDPR, HIPAA, and PCI-DSS necessitates stringent security measures, data encryption protocols, and privacy-enhancing technologies, which may increase the complexity and cost of network engineering projects.

Additionally, the complexity of modern network infrastructures and the interconnected nature of digital ecosystems present challenges in terms of interoperability, compatibility, and vendor lock-in. Organizations may encounter difficulties in integrating disparate systems, managing heterogeneous environments, and ensuring seamless communication between legacy and modern technologies, which can hinder the effectiveness and efficiency of network engineering initiatives.

Opportunities:

Despite the challenges, the network engineering services market presents significant opportunities for growth and innovation. One such opportunity lies in the adoption of emerging technologies such as artificial intelligence (AI), machine learning (ML), and automation within network engineering workflows. These technologies enable predictive analytics, self-healing networks, and autonomous operations, allowing organizations to enhance efficiency, reliability, and agility while reducing operational costs.

Moreover, the increasing focus on sustainability and environmental responsibility presents opportunities for network engineering services providers to develop eco-friendly solutions that optimize energy consumption, reduce carbon emissions, and minimize environmental impact. By implementing energy-efficient network architectures, leveraging renewable energy sources, and adopting green networking practices, organizations can achieve cost savings and environmental benefits simultaneously.

Furthermore, the growing demand for managed network services and outsourcing arrangements presents opportunities for network engineering services providers to expand their offerings and tap into new markets. By offering comprehensive managed services such as network monitoring, maintenance, and support, providers can alleviate the burden on internal IT teams, enhance service quality, and deliver value-added solutions that meet the evolving needs of their clients.

Additionally, the convergence of networking and other IT disciplines such as cybersecurity, cloud computing, and data analytics creates opportunities for network engineering services providers to diversify their service portfolios and address multifaceted customer requirements. By offering integrated solutions that span multiple domains, providers can position themselves as trusted advisors and strategic partners to their clients, driving long-term partnerships and revenue growth.

Read Also: Open RAN Market Size to Worth USD 32 Billion by 2033

Recent Developments

- In July 2022, Mphasis allocated ₹21 crore to support fundamental and applied research in quantum technologies at IIT Madras. The collaboration involves a Memorandum of Understanding (MoU) between Indian Institute of Technology Madras and Mphasis, with the goal of establishing a hub for quantum science and technology. The partnership aims to foster high-quality graduates by encouraging research in both fundamental and applied aspects of quantum technologies.

- In August 2022, SkyMax and Ericsson formalized a partnership through a Memorandum of Understanding (MoU) to develop an advanced 5G broadband network and digital services delivery platform across Sub-Saharan Africa (SSA).

- In August 2022, TCS achieved the Compliance and Privacy distinction in the AWS Security Competency, setting it apart as an AWS Partner specializing in consulting services tailored for large global enterprises. These services aid in the adoption, development, and deployment of security measures in AWS environments, enhancing overall security posture.

- In August 2022, Ericsson unveiled a groundbreaking triple-band, tri-sector radio (Radio 6646) capable of performing the functions of nine radios. This innovation significantly reduces energy consumption by 40% compared to triple-band single-sector radios and decreases weight by 60%, incorporating aluminum for a more environmentally friendly solution.

- In September 2022, Juniper Networks introduced Apstra Freeform, an expansion of its multivendor data center automation and assurance platform. This capability empowers Juniper’s enterprise, service provider, and cloud provider customers to efficiently manage and automate their data center operations, irrespective of topology and protocols used.

Network Engineering Services Market Companies

- Cisco Systems, Inc.

- Juniper Networks, Inc.

- Huawei Technologies Co., Ltd.

- Arista Networks, Inc.

- Nokia Corporation

- Hewlett Packard Enterprise (HPE)

- Dell Technologies, Inc.

- Extreme Networks, Inc.

- Ericsson AB

- Broadcom Inc.

- IBM Corporation

- F5 Networks, Inc.

- Palo Alto Networks, Inc.

- Fortinet, Inc.

- Check Point Software Technologies Ltd.

Segments Covered in the Report

By Service Type

- Professional Services

- Managed Services

By Connection Type

- Wired

- Wireless

By End-use

- Communication Service Providers (CSPs)

- Enterprises

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/