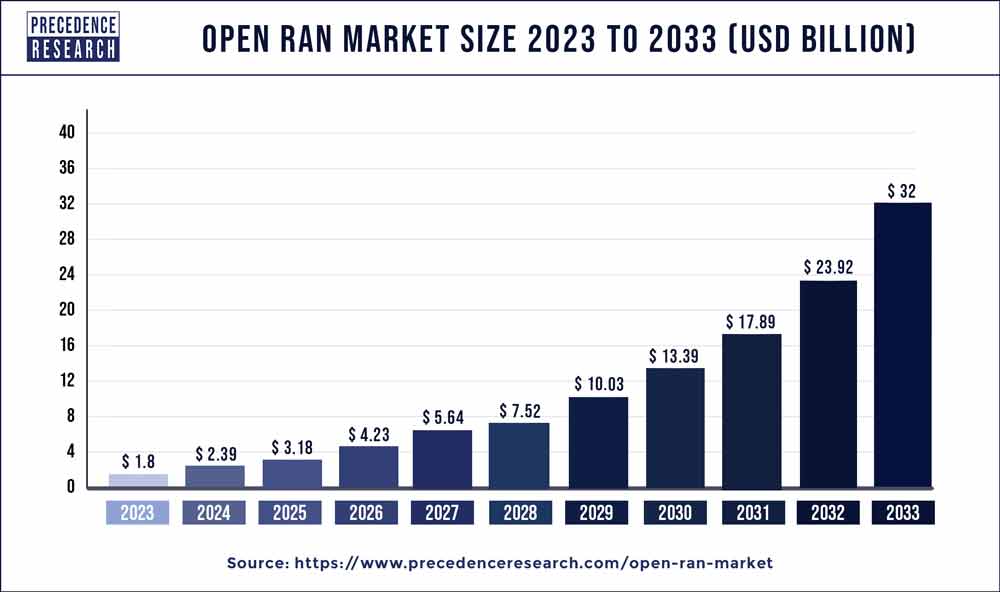

The global open RAN market size reached USD 1.8 billion in 2023 and is projected to rake around USD 32 billion by 2033, notable at a CAGR of 33.40% from 2024 to 2033.

Key Points

- North America contributed 45% of market share in 2023.

- Asia-Pacific is estimated to expand the fastest CAGR between 2024 and 2033.

- By component, the hardware segment has held the largest market share of 49% in 2023.

- By component, the services segment is anticipated to grow at a remarkable CAGR of 35.3% between 2024 and 2033.

- By unit, the radio unit segment generated over 39% of the market share in 2023.

- By unit, the distributed unit segment is expected to expand at the fastest CAGR over the projected period.

- By deployment, the hybrid cloud segment generated 50% of the market share in 2023.

- By deployment, the private cloud segment is expected to expand at the fastest CAGR over the projected period.

Introduction

The Open RAN (Radio Access Network) market has emerged as a disruptive force in the telecommunications industry, redefining the traditional approach to network infrastructure deployment and management. Open RAN represents a paradigm shift from proprietary, vendor-specific hardware to open and interoperable solutions, fostering innovation, flexibility, and cost-efficiency in network deployment and operation. This market is characterized by a diverse ecosystem of vendors, operators, and technology providers collaborating to develop standardized interfaces and protocols, driving the evolution of next-generation wireless networks.

Get a Sample: https://www.precedenceresearch.com/sample/3741

Growth Factors

Several factors contribute to the rapid growth of the Open RAN market. Firstly, the demand for increased network capacity and coverage, driven by the proliferation of data-intensive applications and the advent of 5G technology, fuels the deployment of Open RAN solutions. Additionally, the cost-saving potential offered by Open RAN architectures, including reduced capital expenditure (CapEx) and operational expenditure (OpEx) through hardware commoditization and vendor-neutral software, attracts operators seeking to optimize their network investments. Moreover, regulatory initiatives promoting open standards and interoperability further stimulate market growth by fostering competition and innovation in the telecommunications sector.

Open RAN Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 33.40% |

| Global Market Size in 2023 | USD 1.8 Billion |

| Global Market Size by 2033 | USD 32 Billion |

| U.S. Market Size in 2023 | USD 0.56 Billion |

| U.S. Market Size by 2033 | USD 10.16 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Component, By Unit, and By Deployment |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Open RAN Market Dynamics

Drivers

Several drivers propel the adoption of Open RAN solutions across the telecommunications industry. One of the primary drivers is the need for network disaggregation and virtualization, enabling operators to decouple hardware and software components, thereby facilitating agility, scalability, and innovation in network deployment and management. Additionally, the emergence of new use cases, such as edge computing, Internet of Things (IoT), and Industry 4.0 applications, necessitates flexible and programmable network architectures provided by Open RAN solutions. Furthermore, strategic partnerships and alliances among industry stakeholders, including telecom operators, technology vendors, and standardization bodies, accelerate the development and deployment of Open RAN technologies, driving market expansion and maturity.

Restraints

Despite its rapid growth and adoption, the Open RAN market faces several challenges and restraints that may impede its widespread deployment and scalability. One significant restraint is interoperability and integration complexities arising from the heterogeneous nature of Open RAN ecosystems, comprising multiple vendors, interfaces, and protocols. Ensuring seamless interoperability and compatibility between different components and vendors requires significant investments in testing, validation, and integration efforts, posing a barrier to adoption for some operators. Additionally, concerns regarding performance, reliability, and security of Open RAN solutions compared to traditional integrated systems may hinder adoption, particularly in mission-critical applications and enterprise deployments. Moreover, the lack of standardized interfaces and protocols across the Open RAN ecosystem complicates vendor selection, deployment, and management, inhibiting market growth and consolidation.

Opportunities

Despite the challenges and restraints, the Open RAN market presents significant opportunities for innovation, disruption, and growth in the telecommunications industry. Firstly, the growing momentum towards cloud-native and software-defined architectures creates opportunities for Open RAN vendors to develop scalable, flexible, and agile solutions, leveraging cloud computing, virtualization, and containerization technologies. Additionally, the proliferation of 5G networks and emerging use cases, such as augmented reality (AR), virtual reality (VR), and ultra-reliable low-latency communication (URLLC), drive demand for Open RAN solutions capable of delivering high-performance, low-latency connectivity. Furthermore, initiatives aimed at fostering collaboration and standardization within the Open RAN ecosystem, such as the Telecom Infra Project (TIP) and Open RAN Policy Coalition, facilitate interoperability, innovation, and ecosystem development, unlocking new opportunities for market players to collaborate and differentiate their offerings.

Read Also: Network as a Service Market Size to Cross USD 192.3 Bn by 2033

Recent Developments

- In June of 2022, the collaboration between Ericsson and Orange Egypt reached a milestone as they successfully finalized the consolidation, upgrade, and modernization of Orange Egypt’s mediation system. This advancement empowered Ericsson to efficiently filter out irrelevant data and transform it into the required format for data consumers.

- In May 2022, Huawei and Emirates formalized an agreement that encompasses collaborative marketing efforts on joint projects and promotional activities. The primary focus of this collaboration is to extend their influence in each other’s domestic markets.

- February 2022 witnessed a joint initiative by Nokia and AT&T, as they worked together to develop an RIC (RAN Intelligent Controller) software platform. Successful trials were conducted with external applications, referred to as “xApps,” at the edge of AT&T’s operational 5G mmWave network on an Open Cloud Platform. Nokia and AT&T are committed to enhancing the 5G uplink through the implementation of distributed massive MIMO technology.

Open RAN Market Companies

- Mavenir

- Altiostar

- Parallel Wireless

- Radisys

- NEC Corporation

- Qualcomm

- Samsung

- Airspan Networks

- Fujitsu

- NEC Corporation

- Cisco

- Nokia

- Intel Corporation

- ZTE Corporation

- VMware

Segments Covered in the Report

By Component

- Hardware

- Software

- Services

By Unit

- Radio Unit

- Distributed Unit

- Centralized Unit

By Deployment

- Private

- Hybrid Cloud

- Public Cloud

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/