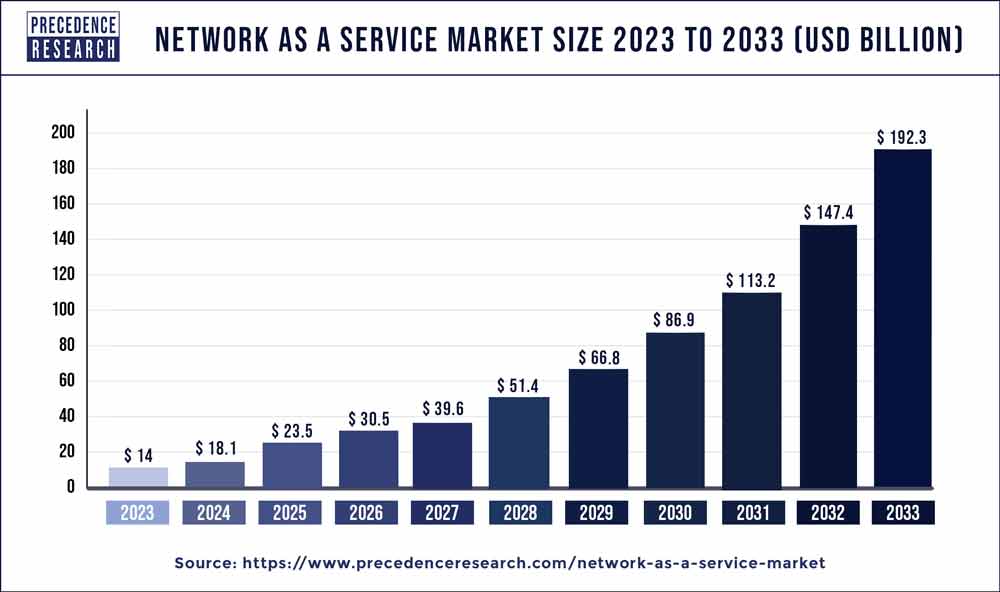

The global network as a service market size was valued at USD 14 billion in 2023 and is expected to reach around USD 192.3 billion by 2033, notable at a CAGR of 30% from 2024 to 2033.

Key Points

- North America contributed 42% of the share in the network as a service market in 2023.

- Asia-Pacific is estimated to expand the fastest CAGR between 2024 and 2033.

- By type, the WAN as a service segment held the largest market share of 53% in 2023.

- By type, the LAN as a service segment is anticipated to grow at a remarkable CAGR of 18.7% between 2024 and 2033.

- By enterprise type, the large enterprise segment generated over 56% of the market share in 2023.

- By enterprise type, the small and medium-sized enterprise segment is expected to expand at the fastest CAGR over the projected period.

- By end-user, the corporate customers segment generated over 59% of the market share in 2023.

- By end-user, the individual customers segment is expected to expand at the fastest CAGR over the projected period.

Introduction

The Network as a Service (NaaS) market has emerged as a disruptive force in the realm of networking, transforming the way businesses manage and deploy their network infrastructure. NaaS provides a cloud-based networking model that allows organizations to access and utilize network resources on-demand, as a service, rather than investing in and maintaining physical networking hardware. This paradigm shift offers numerous benefits, including increased flexibility, scalability, and cost-effectiveness, which are driving the adoption of NaaS solutions across various industries.

Get a Sample: https://www.precedenceresearch.com/sample/3740

Growth Factors

Several key factors are fueling the growth of the Network as a Service market. Firstly, the rapid proliferation of cloud computing and the rise of digital transformation initiatives have led organizations to seek more agile and efficient networking solutions. NaaS offers a flexible and scalable alternative to traditional networking approaches, enabling businesses to adapt quickly to changing requirements and support emerging technologies such as IoT (Internet of Things) and edge computing.

Moreover, the growing demand for software-defined networking (SDN) and network virtualization technologies is driving the adoption of NaaS solutions. These technologies decouple network control and forwarding functions, allowing for centralized management and automation of network resources, which aligns perfectly with the NaaS model. Organizations are increasingly recognizing the advantages of SDN-enabled NaaS in terms of simplifying network management, optimizing performance, and enhancing security.

Additionally, the increasing emphasis on cost optimization and operational efficiency is prompting enterprises to explore NaaS offerings. By shifting from capital-intensive, hardware-centric networking models to subscription-based NaaS solutions, organizations can reduce upfront infrastructure costs, minimize ongoing maintenance expenses, and achieve greater financial predictability. This cost-effectiveness, coupled with the ability to pay only for the resources they consume, is a compelling driver for NaaS adoption.

Network as a Service Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 30% |

| Global Market Size in 2023 | USD 14 Billion |

| Global Market Size by 2033 | USD 192.3 Billion |

| U.S. Market Size in 2023 | USD 4.12 Billion |

| U.S. Market Size by 2033 | USD 57 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Type, By Enterprise Type, and By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Network as a Service Market Dynamics

Drivers

Several drivers are propelling the growth of the Network as a Service market. One of the primary drivers is the rising adoption of cloud-based services and applications. As businesses migrate their workloads to the cloud, there is a growing need for reliable, high-performance network connectivity that can seamlessly integrate with cloud environments. NaaS providers offer robust networking solutions that are optimized for cloud deployments, enabling organizations to achieve greater agility and scalability in their cloud-based operations.

Furthermore, the increasing complexity of modern IT environments, characterized by distributed workforces, hybrid cloud architectures, and diverse endpoint devices, is driving demand for more flexible and dynamic networking solutions. NaaS platforms leverage technologies such as SDN, NFV (Network Functions Virtualization), and automation to deliver agile, software-driven networking capabilities that can adapt to evolving business requirements and support the diverse needs of today’s digital enterprises.

Moreover, the growing focus on digital innovation and business agility is prompting organizations to rethink their approach to networking. Traditional, hardware-centric networking models are often rigid and slow to adapt to changing business demands. In contrast, NaaS solutions offer a more agile and responsive networking infrastructure that can quickly provision and scale network resources based on application requirements, enabling businesses to innovate faster and stay ahead of the competition.

Restraints

Despite the promising growth prospects, the Network as a Service market faces certain restraints that may hinder its widespread adoption. One significant challenge is the concern over data privacy and security in cloud-based networking environments. As organizations entrust their critical data and applications to third-party NaaS providers, they must ensure that robust security measures are in place to safeguard against cyber threats, data breaches, and unauthorized access.

Another restraint is the potential for vendor lock-in and interoperability issues. As organizations adopt NaaS solutions from specific providers, they may become dependent on proprietary technologies and protocols that limit their ability to integrate with other platforms or switch providers easily. This lack of interoperability can hinder flexibility and vendor choice, potentially leading to vendor dependence and limited options for customization or optimization.

Additionally, the complexity of migrating from legacy networking infrastructure to NaaS platforms can pose a significant challenge for organizations, particularly those with large, distributed networks or mission-critical applications. The transition to NaaS requires careful planning, resource allocation, and expertise to ensure a seamless migration process without disrupting business operations or compromising network performance.

Opportunity

Despite these challenges, the Network as a Service market presents significant opportunities for vendors, service providers, and end-users alike. One key opportunity lies in the growing demand for managed networking services, particularly among small and medium-sized enterprises (SMEs) that lack the resources or expertise to manage their network infrastructure internally. NaaS providers can capitalize on this trend by offering comprehensive managed services that encompass network design, deployment, monitoring, and optimization.

Furthermore, the increasing adoption of emerging technologies such as 5G, IoT, and edge computing is creating new opportunities for NaaS providers to deliver innovative networking solutions tailored to the unique requirements of these applications. By leveraging the scalability, flexibility, and low-latency capabilities of NaaS platforms, organizations can deploy advanced network services that support real-time data processing, distributed computing, and mission-critical IoT applications.

Moreover, the shift towards hybrid and multi-cloud environments presents an opportunity for NaaS providers to offer seamless connectivity and integration between on-premises data centers, public cloud providers, and edge locations. By providing unified networking solutions that span across disparate cloud environments, NaaS providers can help organizations simplify network management, optimize performance, and enhance security across their distributed IT infrastructure.

Read Also: AI Camera Market Size to Worth USD 67.41 Billion by 2033

Recent Developments

- In May 2023, Cloudflare Inc. joined forces with IT services giant Kyndryl to unveil a novel managed WAN as a Service offering. This strategic partnership integrated networking services with Cloudflare’s Magic WAN DDoS mitigation and connectivity platform, aiming to elevate performance and security for users making the transition to modern IT technologies.

- In April 2023, Hewlett Packard Enterprise (HPE) introduced an upgraded version of its cloud management platform, HPE Aruba Networking Central, during its Atmosphere event. This release featured AI for IT operations (AIOps) and enhanced network capabilities. Utilizing the GreenLake platform, HPE provided Artificial Intelligence (AI)-powered data analytics and performance optimizations for network administrators.

- Megaport and colocation provider Element Critical collaborated in May 2023 to launch a Network as a Service (NaaS) platform. Through this partnership, customers gained access to Megaport’s software-defined networks and cloud interconnection services, enabling them to connect their allocated assets directly to multiple cloud providers and branch offices via a single network port. This initiative aimed to offer enhanced control and cost management capabilities.

- In July 2022, Amazon Web Services, Inc. announced the general availability of AWS Cloud WAN, a managed WAN service facilitating the connection of site-to-site, inter-region workloads, and site-to-cloud in AWS. The platform was seamlessly integrated with leading SD-WAN vendors such as Aruba, Checkpoint, Prosimo, Aviatrix, Cisco, and VMware.

- In April 2022, Aryaka received software-defined core (SD-core) technology and software-defined wide area network (SD-WAN) service from SoftBank Corp, a prominent Japanese conglomerate. This collaboration was driven by SoftBank Corp’s need to provide its customers with high-speed and stable data communications, requiring a network that was both adaptable and highly secure.

Network as a Service Market Companies

- Cisco Systems, Inc.

- Juniper Networks, Inc.

- VMware, Inc.

- Aryaka Networks, Inc.

- Megaport Limited

- AT&T Inc.

- IBM Corporation

- Oracle Corporation

- Ciena Corporation

- Comcast Business

- Alcatel-Lucent Enterprise

- Masergy Communications, Inc.

- Verizon Communications Inc.

- GTT Communications, Inc.

- Silver Peak Systems, Inc.

Segments Covered in the Report

By Type

- WAN as a Service

- LAN as a Service

By Enterprise Type

- Small and Medium-sized Enterprise

- Large Enterprise

By End-user

- Corporate Customers

- Individual Customers

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/